Alaska Airlines Rebounds from Boeing Door Plug Incident

Alaska Air Group’s performance in the first quarter of the year showcased resilience and determination in the face of adversity. After a challenging start to the year with a Boeing 737 Max 9 door plug blowout incident in January, the airline took decisive action to ensure the safety of its fleet. This incident led to the grounding of a significant portion of its 737 Max aircraft for safety reviews, resulting in a substantial impact on the company’s operations.

To compensate for the lost revenues from the grounding and the escalating costs associated with inspecting and restoring the planes to service, Boeing stepped up to the plate and issued a $162 million payment to Alaska Airlines. The disclosure of this financial support was made public in a Securities and Exchange Commission filing earlier this month, underscoring the collaboration between the two aviation industry giants.

Positive Outlook and Financial Results

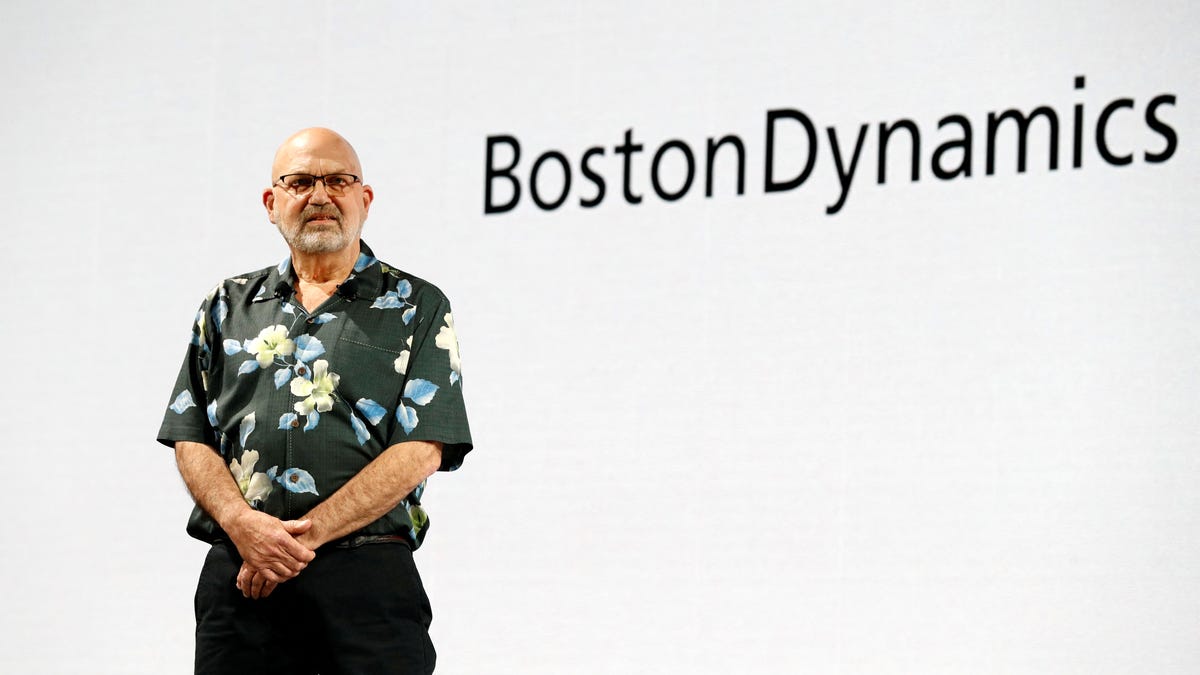

Despite the challenges faced in the first quarter, Alaska CEO Ben Minicucci expressed satisfaction with the overall performance of the company. The quarterly results exceeded initial expectations, leading to a surge in the airline’s stock price by nearly 7% following the earnings report. While the grounded aircraft had a notable impact on the bottom line, the company still managed to show resilience.

Alaska Airlines reported an adjusted loss before income tax of $162 million due to the grounding incident. However, excluding this exceptional effect, the company would have posted a $5 million adjusted income before income tax. Although the accident had a negative impact on earnings and capacity, the company showed improvement compared to the previous year.

Boeing’s Challenges and Regulatory Scrutiny

On the other hand, Boeing faced a different set of challenges as a result of the incident involving its aircraft. The aerospace giant experienced a decline in its stock performance, marking one of the worst-performing stocks on the S&P 500 in 2024. Facing legal action from passengers on the Alaska flight and increased regulatory scrutiny, Boeing navigated a tumultuous period.

Additionally, Boeing’s delivery numbers took a hit in the first quarter, with the company only delivering 83 planes during this period. This marked the lowest quarterly deliveries since 2021, reflecting the impact of external pressures on the manufacturing and delivery process.

Looking Ahead

Despite the challenges faced by both Alaska Airlines and Boeing, there is optimism for the future. Alaska Airlines provided a second-quarter earnings-per-share guidance of between $2.20 and $2.40, indicating a positive trajectory for the company. As the aviation industry continues to recover from setbacks, both companies are poised to navigate the challenges ahead with resilience and determination.

Image/Photo credit: source url