Analysis of Bitcoin Accumulation Trends Among Different Investor Cohorts

The digital asset market is currently experiencing a notable surge in Bitcoin (BTC) accumulation, particularly across two distinct investor cohorts known as Shrimps and Sharks. These two groups represent different categories of investors with varying levels of Bitcoin holdings and investment strategies.

The Shrimp Cohort: Retail Investors

The “Shrimp cohort” consists of retail investors who hold less than one Bitcoin each and have historically been known to steadily increase their holdings over time. Recent data from Glassnode reveals that this group has been engaging in particularly aggressive accumulation activities, with a collective increase of 16,769 BTC over the past 30 days. This brings their total Bitcoin holdings to approximately 1.37 million BTC, marking a significant uptick in their accumulation efforts since November 2023.

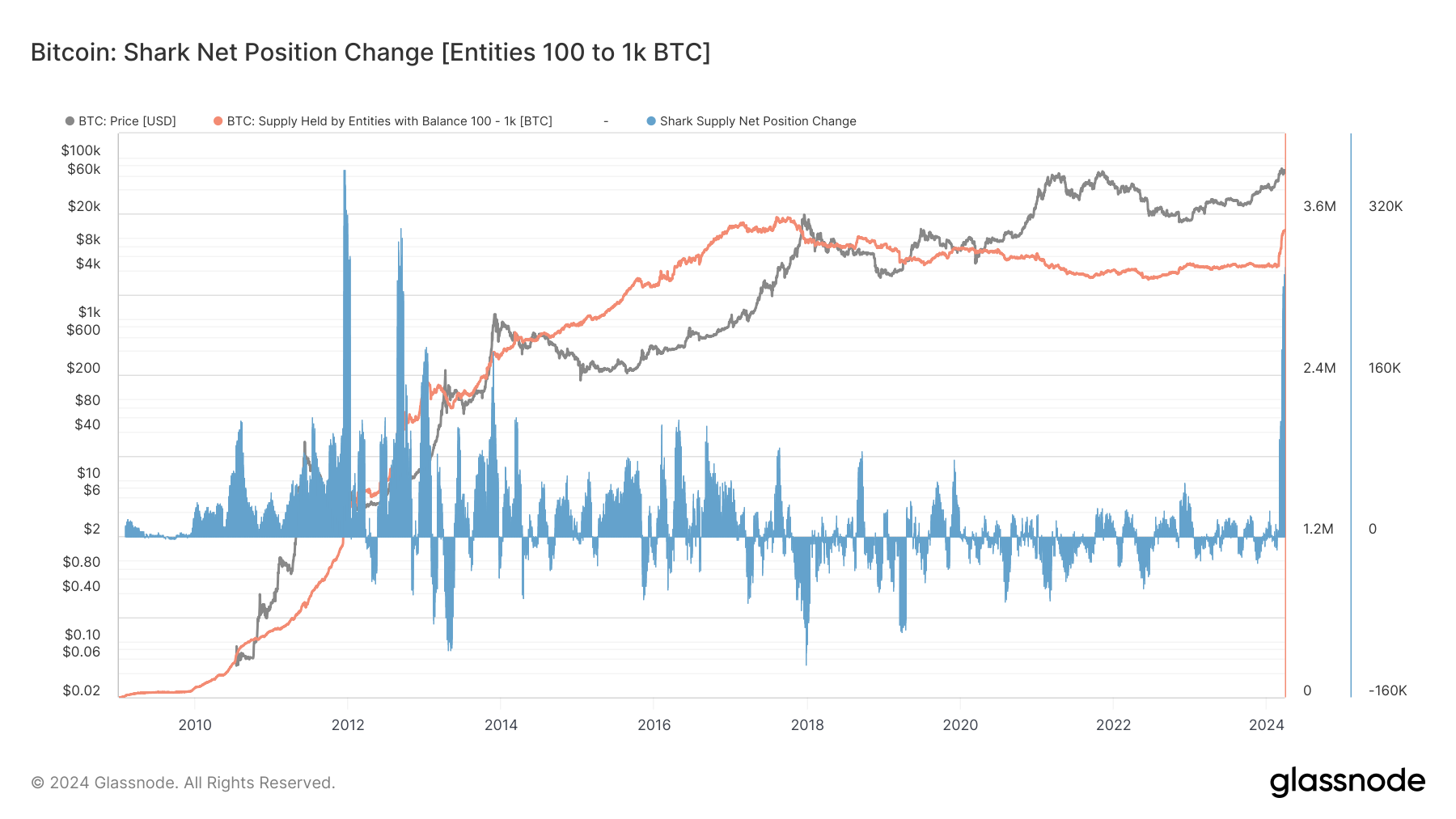

The Shark Cohort: Higher-Net-Worth Individuals and Institutions

In contrast, the “Shark” cohort comprises higher-net-worth individuals, trading desks, and institutional entities that hold between 100 and 1,000 BTC each. This group has also been actively accumulating Bitcoin, with a 30-day net position change of 268,441 BTC – the largest increase seen since 2012. Collectively, the Shark cohort now holds a staggering 3.5 million Bitcoin, according to Glassnode data.

These accumulation trends among both investor cohorts indicate a growing bullish sentiment in the market, as all groups combined have been acquiring more Bitcoin than the monthly issuance over the past 30 days. This suggests a strong conviction among investors regarding the future value and potential of Bitcoin as a digital asset.

Overall, the data presented by Glassnode underscores the increasing interest and confidence in Bitcoin among both retail investors and higher-net-worth individuals and institutions. The accelerated accumulation witnessed in recent months reflects a broader positive outlook on the long-term prospects of Bitcoin as a valuable investment and store of value in the digital asset market.

Image/Photo credit: source url