Bitcoin Miners Facing Off Against AI Boom Ahead of Halving

Bitcoin miners are encountering a new challenge as they prepare for this week’s halving event: competition from the booming artificial intelligence (AI) industry. According to analysts at AllianceBernstein, Gautam Chhugani, and Mahika Sapra, miners are now finding themselves in competition with AI data centers, particularly in locations such as Texas.

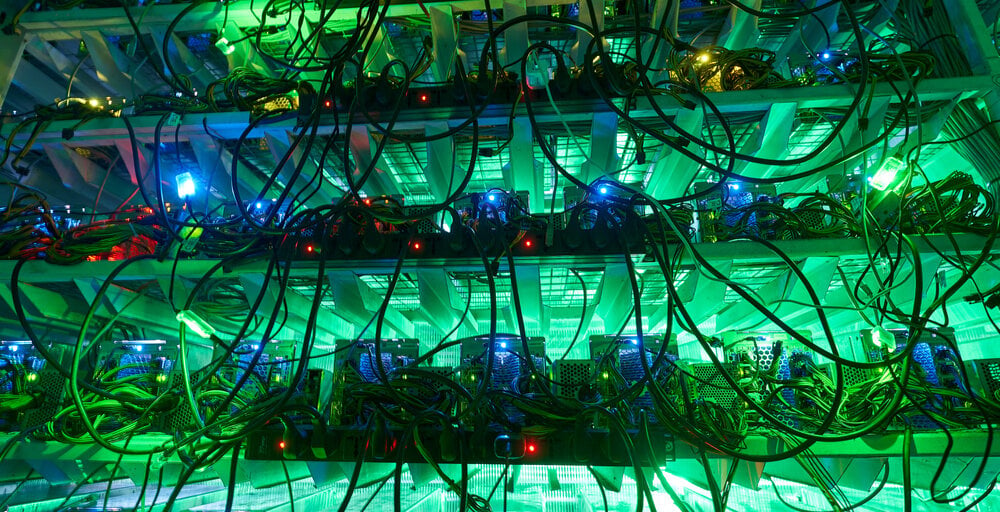

Bitcoin mining operations are generally centralized entities that are responsible for creating new digital currency. This process requires a significant amount of computational power and, consequently, a substantial amount of energy. On the other hand, the AI industry, which is also experiencing rapid growth, is known for its energy-intensive operations. Both industries are drawn to locations like Texas due to the availability of cheap energy and ample space for constructing data centers.

Competition for Resources

Today’s report highlights the escalating competition between Bitcoin miners and the AI industry for resources, particularly in terms of land acquisition and power contracts. The report notes that this competition has made securing power contracts and suitable land more challenging for miners.

However, the report also suggests that the AI industry’s rapid growth could benefit miners who have excess capital. Manufacturers of Bitcoin ASIC chips have faced stiff competition from the demand for powerful AI chips. In response, these manufacturers have sought bulk contracts and purchase options with financially stable miners.

Preparations for the Halving

As miners gear up for the halving event, they are focused on enhancing their efficiency to remain competitive. The halving, which occurs every four years, will reduce the mining rewards from 6.25 BTC to 3.125 BTC. This significant reduction underscores the importance of operating more efficiently to maintain profitability.

Despite the current price dip in Bitcoin, mining CEOs have expressed confidence in their companies’ financial positions leading up to the halving. They have highlighted the relatively low debt on their balance sheets and the absence of equipment financing arrangements involving mining rigs.

Bitcoin’s price has dipped below its previous all-time high of nearly $74,000 per coin recorded in March. As of now, Bitcoin is trading at $63,145, below the peak of $69,044 it reached in 2021, as reported by CoinGecko.

Overall, the evolving landscape of the cryptocurrency mining industry, coupled with the burgeoning AI sector, presents new challenges and opportunities for Bitcoin miners as they navigate the upcoming halving event.

Image/Photo credit: source url