Analysis of Bitcoin’s On-Chain Data

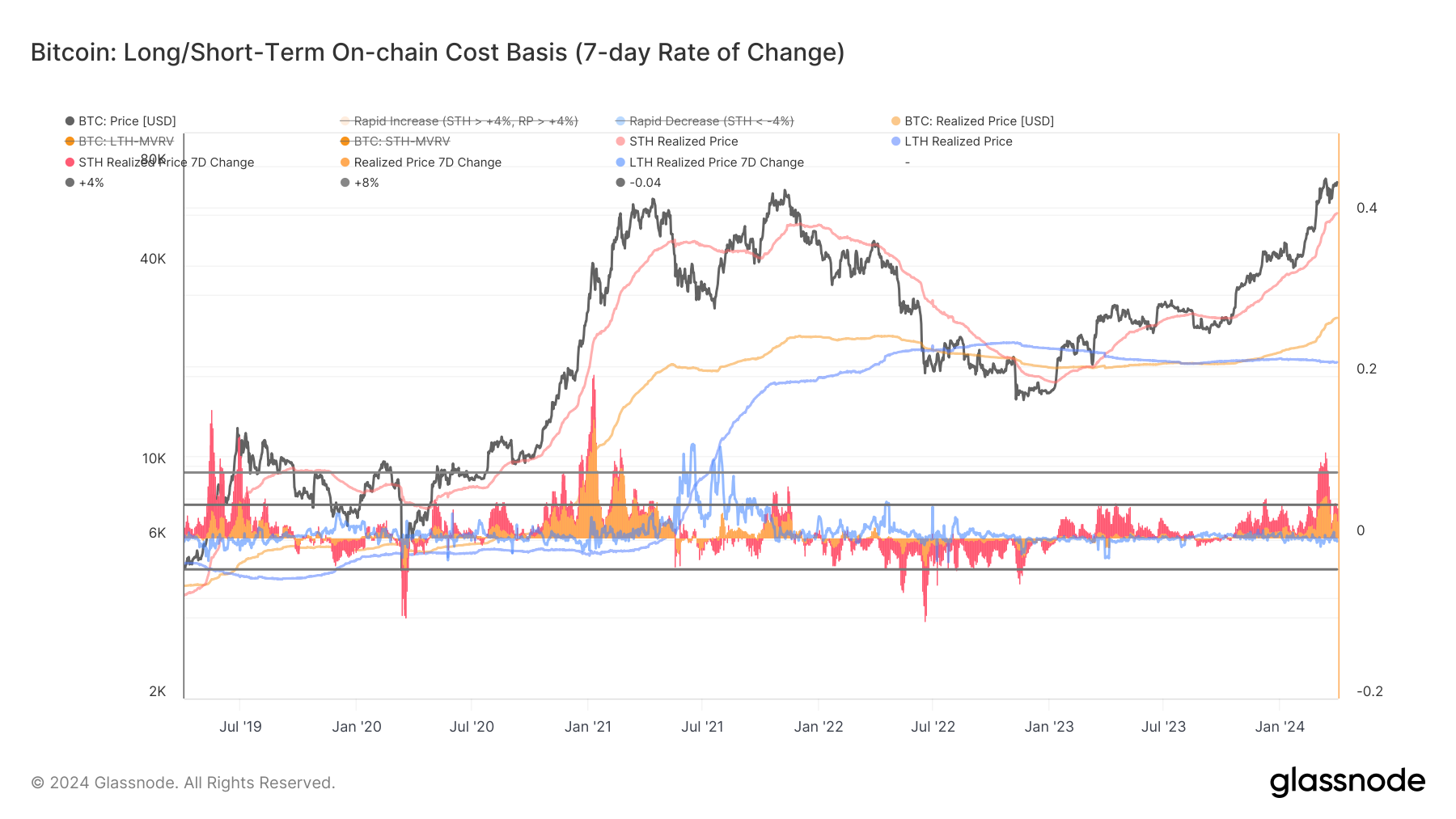

Recent on-chain data analysis of Bitcoin by Glassnode indicates a bullish sentiment within the market. This positivity is driven by the strong support levels that are influenced by the behavior of short-term holders. The Short-Term Holder Realized Price (STH RP), which represents the average on-chain acquisition cost for coins that have been moved within the last 155 days, has spiked to an all-time high of $57,547. This surge is further reinforced by a 7-day percentage change of 4%, significantly higher compared to previous trends, including an extraordinary 11% surge, marking the highest level since 2021.

Consistent Support Levels

Over the course of the last 14 months, the Short-Term Holder Realized Price (STH RP) has consistently served as a reliable price floor for Bitcoin. There was a minor exception noted in July and August of 2023, but overall, current market conditions reflect those observed in late 2020. During this period, Bitcoin exhibited a persistent upward trend accompanied by shallow dips, maintaining strong support levels just above the STH RP threshold. Additionally, the overall Realized Price of Bitcoin across its circulating supply has skyrocketed to approximately $28,000, reaching an unprecedented high.

Increasing Accumulation by Short-Term Holders

The data suggests that short-term holders are actively accumulating Bitcoin at progressively higher price levels. As long as the market continues to follow these realized prices, Bitcoin’s upward trajectory is likely to continue. This could potentially result in modest drawdowns compared to previous market cycles, indicating a positive outlook for the cryptocurrency.

The insights gleaned from this on-chain data analysis provide valuable information regarding the current state of the Bitcoin market. The robust support levels, driven by short-term holders’ behavior, suggest a bullish trend that may lead to sustained growth in the cryptocurrency’s value. By closely monitoring these on-chain metrics, investors and analysts can gain a deeper understanding of market dynamics and make informed decisions regarding their Bitcoin holdings.

Image/Photo credit: source url