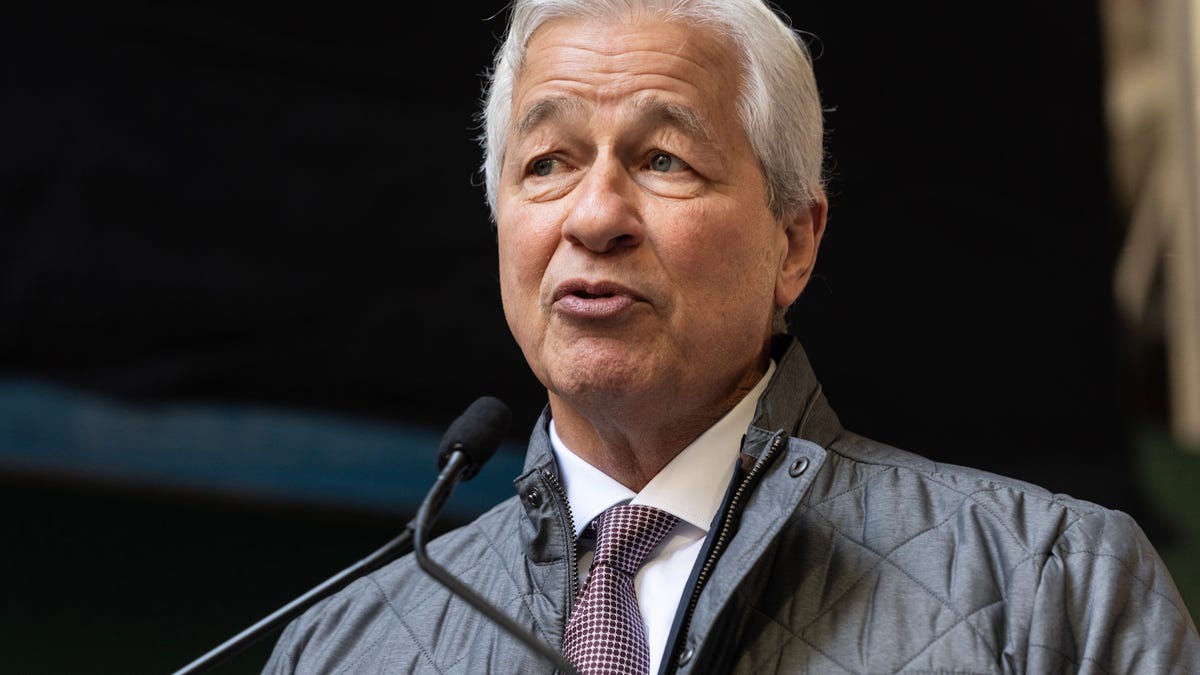

Jamie Dimon’s Share Sale

Recently, Jamie Dimon, the CEO of JPMorgan Chase & Co., earned over $180 million by selling 1 million shares of the company. In a Securities and Exchange Commission filing dated Monday, it was revealed that Dimon made nearly $33 million from selling 178,222 shares of the investment bank. This sale follows a previous transaction in February, where Dimon had already sold about $150 million worth of shares.

Notably, this share sale marked Dimon’s first time selling shares in his nearly two-decade tenure as CEO. The bank clarified that the sale was primarily for financial diversification and tax-planning purposes. With this recent sale, Dimon has completed his planned share sell-off, adding to his substantial compensation of $36 million from the bank in 2023, demonstrating a 4.3% increase from the previous year.

JPMorgan’s Financial Performance

In addition to Dimon’s share sale, JPMorgan Chase & Co. announced a 10% increase to its quarterly common dividend, now totaling $1.15 per share. This dividend is set to be payable to stockholders at the end of April. The bank also reported significant financial moves, including a repurchase of $2 billion worth of common stock in the first quarter of 2024.

Further highlighting JPMorgan’s financial prowess, the company boasted a revenue of $41.9 billion in the first quarter ending on March 31, with a net income of $13.4 billion, marking a 6% increase from the same period in the preceding year. These results show the bank’s continued strong performance and strategic financial planning.

CEOs Selling Shares

Dimon is not alone in selling shares of his company, as other notable CEOs and business figures have engaged in similar transactions:

- Jeff Bezos: The Amazon co-founder embarked on selling shares in February, expecting to earn an estimated $8.4 billion from the sales.

- Mark Zuckerberg: Meta Platform’s CEO sold 1.28 million shares totaling $428 million in the last two months of 2023.

- Leon Black: The former CEO and co-founder of Apollo Global Management sold off $172.8 million of his stock in the company, marking his first-ever stock sale.

- The Walton Family: The heirs to Walmart parted with $1.5 billion in Walmart stock in February during a stock rally.

- Elon Musk: The Tesla and SpaceX boss sold roughly $40 billion worth of Tesla stock in 2022.

These instances illustrate how top executives often make strategic decisions regarding their company shares to align with financial goals and opportunities for diversification.

Image/Photo credit: source url