The Challenge Against SEC’s Guidance on Crypto Custody Services

In a bid to challenge the U.S. Securities and Exchange Commission (SEC), pro-crypto Republicans are gearing up to take action this week. They are demanding the agency to rescind its current guidance, which they argue dissuades banks from offering cryptocurrency custody services.

The Legislative Action

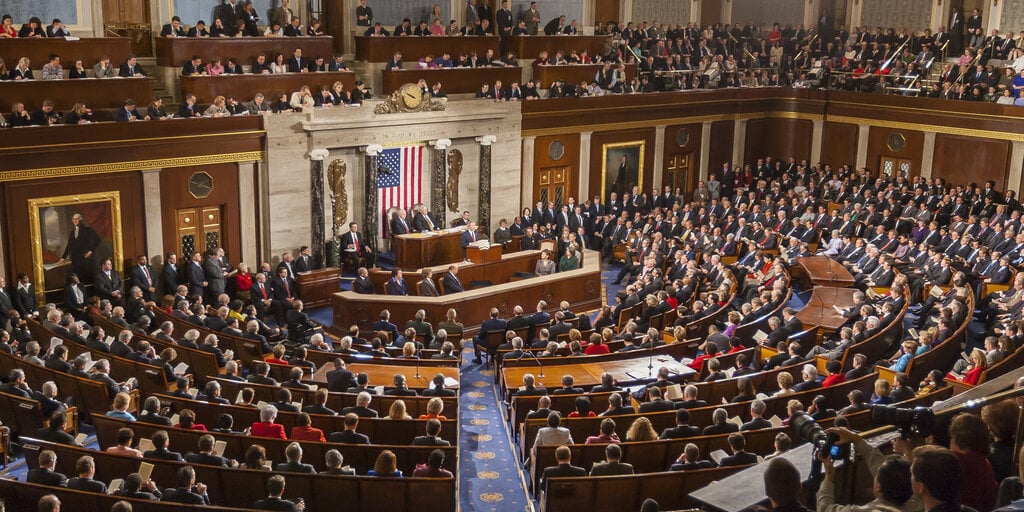

On Wednesday, the House of Representatives is set to vote on a joint resolution proposed by Rep. Mike Flood (R-Nebraska) that calls for congressional disapproval of Staff Accounting Bulletin (SAB) 121. A similar resolution has been introduced in the Senate as well.

The SEC’s Staff Accounting Bulletin (SAB) 121, available on its website, provides insights from SEC staff on the risks associated with crypto custodianship and outlines disclosure requirements under federal securities laws. While the SEC labels SABs as guidance rather than formal regulations, Rep. Flood argues that SAB 121 constitutes a significant and controversial policy shift. He criticized the SEC for bypassing the conventional development process for SABs, which typically involves collaboration with Federal banking agencies.

Criticism of SEC’s Approach

Rep. Flood expressed disappointment in the SEC’s attempt to sidestep formal rulemaking processes while claiming that SAB 121 is merely non-binding guidance. Within SAB 121, the SEC highlights various risks, including technological, legal, and regulatory factors unique to crypto custodians. These risks, according to the SEC, could have a substantial impact on the financial condition and operations of entities involved in crypto custodianship. Rep. Flood contends that such warnings have discouraged banks and broker-dealers from engaging in the safekeeping of digital assets, despite the SEC’s prior approval of Bitcoin spot ETFs.

He asserts, “The SEC’s actions have hindered the traditional practice of safeguarding digital assets, making it excessively costly for credible and well-regulated institutions to participate.”

Support and Critique from Capitol Hill

Tom Emmer (R-Minn.), a vocal critic of the SEC within Capitol Hill, supported Rep. Flood’s legislation. Emmer denounced SAB 121 as illegitimate and accused the SEC of attempting to assert undue regulatory control over the crypto industry.

Emmer stated, “SAB 121 introduces additional concentration risk into the digital asset ecosystem, undermining the fairness, orderliness, and efficiency of our markets. Foreign banks are already capitalizing on this space, leaving the U.S. at a disadvantage.”

Implications and Potential Resolutions

The SEC has initiated legal actions against several prominent crypto firms, including exchanges, custodial service providers, and software developers. These lawsuits target companies such as Coinbase, Binance, Kraken, Uniswap Labs, and Robinhood.

If the joint resolution, known as H.J.Res.109, secures approval in the House, it will still need to pass through the Senate. The companion resolution, S.J.Res.59, is currently under committee review in the Senate. The resolution would become law with a two-thirds majority vote in both chambers.

Image/Photo credit: source url