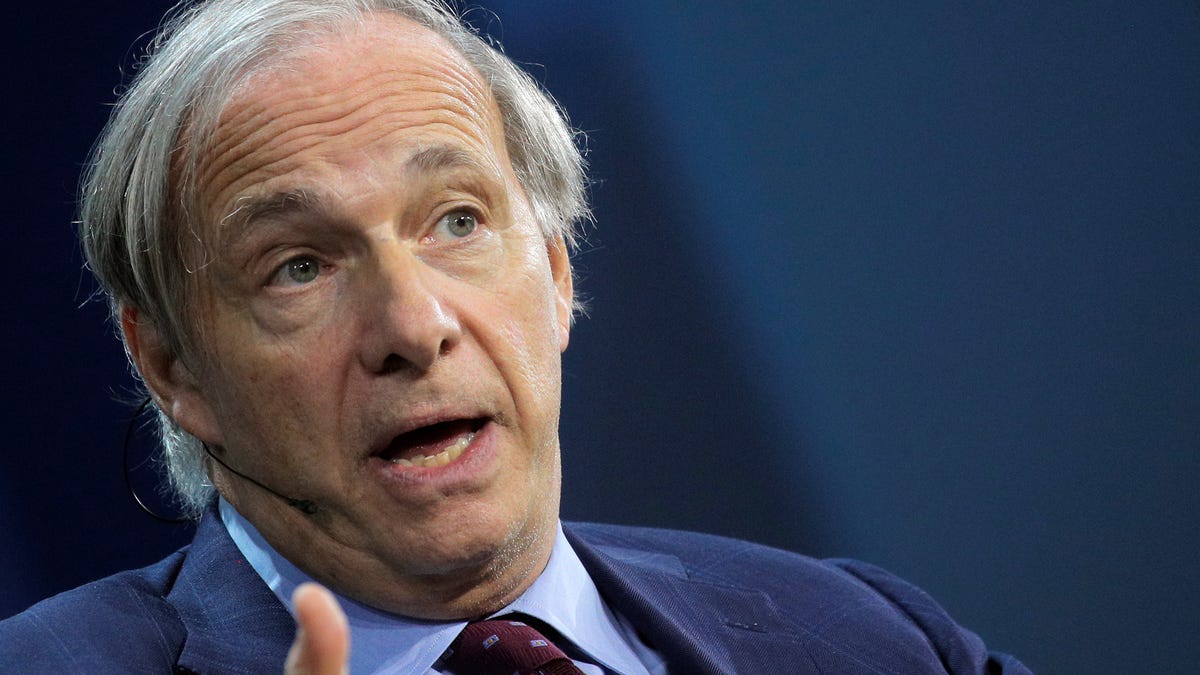

Ray Dalio on China’s Investment Potential

Renowned investor and Bridgewater Associates founder Ray Dalio recently expressed his unwavering commitment to investing in China, despite the challenges and uncertainties that have surrounded the U.S.-China relationship in recent years. In a thought-provoking LinkedIn post, Dalio highlighted the profound personal and professional relationships he has forged with the Chinese people and culture over four decades, emphasizing how these connections drive his investment decisions in the country.

Investing with a Long-Term Vision

Dalio underscored the success he has found in China, not just in financial terms but also in terms of the valuable lessons he has been able to convey to fellow investors. By diversifying his portfolio intelligently and strategically allocating resources in alignment with market conditions, Dalio has demonstrated that it is possible to thrive in both bullish and bearish market environments.

While acknowledging the challenges and criticisms often associated with investments in China, such as political systems and potential conflicts, Dalio remains steadfast in his belief that the benefits far outweigh the risks. He compares his concerns about China to those he holds for other countries in which he invests, noting that sound investment strategies can transcend geopolitical tensions and economic complexities.

Navigating a Complex Economic Landscape

The strained relationship between the U.S. and China, marked by trade disputes and investment restrictions, has cast a shadow of uncertainty over the Chinese market. Despite these obstacles, Dalio remains optimistic about the growth potential in China, particularly at a time when the country is undergoing a period of economic restructuring and recovery.

Market turbulence in China’s property sector and challenges in its equity markets have generated concerns among investors. However, Dalio views these setbacks as opportunities, suggesting that a contrarian approach to investing—buying when others are hesitant—may yield considerable returns. He lauds China’s efforts at implementing policies like quantitative easing to stimulate economic growth, pointing to these measures as indicators of future stability and growth.

The Value of Contrarian Investing

For Dalio, the current downturn in the Chinese market presents a prime opportunity for investors to capitalize on undervalued assets. He emphasizes the importance of looking beyond short-term challenges and focusing on the long-term prospects for growth and profitability. Dalio’s conviction that the time to invest is when the market sentiment is negative underscores his belief in the resilience and potential of the Chinese economy.

In conclusion, Dalio’s unwavering confidence in China’s investment potential is a testament to his faith in the country’s ability to weather challenges and emerge stronger. As he navigates the complexities of global investment landscapes, Dalio continues to advocate for a strategic and disciplined approach to investing, one that is guided by a deep understanding of market dynamics and a long-term perspective on wealth creation.

Image/Photo credit: source url