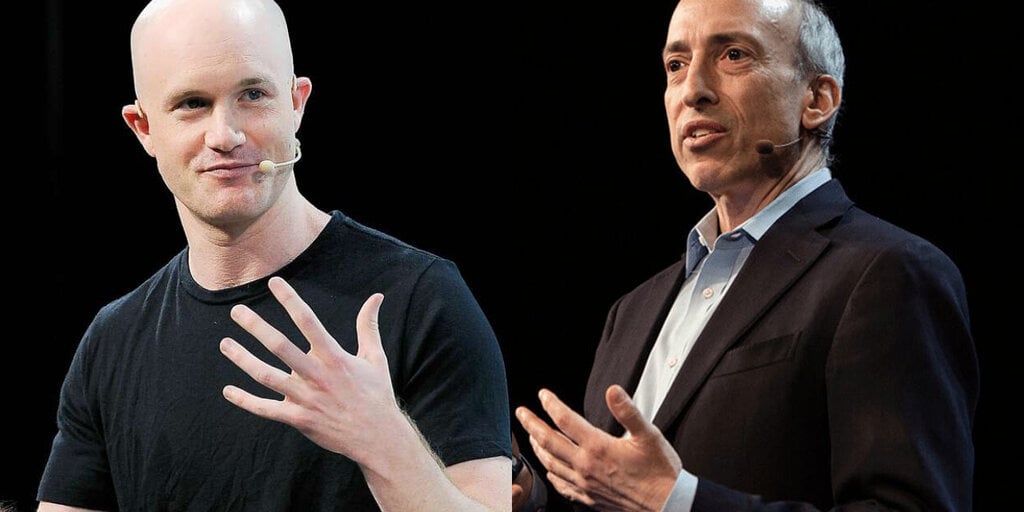

Court Rules in Favor of SEC in Lawsuit Against Coinbase

A federal judge overseeing the U.S. Securities and Exchange Commission’s (SEC) extensive lawsuit against Coinbase determined on Wednesday that the regulator’s arguments against the crypto exchange are largely “plausible.” This decision allows the case to proceed and denies Coinbase’s motion to dismiss it entirely.

It is important to note that rulings on motions to dismiss, like today’s, do not resolve factual disputes. Federal judges only dismiss a case if there is no plausible evidence that a law has been violated, even if assuming all facts alleged by a plaintiff to be true.

In today’s ruling, U.S. District Judge Kathleen Failla not only found most of the SEC’s claims against Coinbase suitable for trial but also expressed support for the agency’s broader, longstanding argument regarding crypto. Judge Failla highlighted that many tokenized assets are considered securities schemes and fall under the SEC’s jurisdiction.

One of the major claims that Judge Failla supported was that Coinbase operates as an unregistered securities exchange for both retail and institutional investors. Additionally, she acknowledged that its crypto staking programs could be viewed as additional offerings of unregistered securities.

However, a third claim asserting that Coinbase conducts brokerage activity through the Coinbase Wallet was dismissed by Judge Failla. This could potentially weaken Coinbase’s overall case against the SEC.

Coinbase’s Response and Next Steps

Following the ruling, Coinbase’s Chief Legal Officer Paul Grewal expressed that he was not surprised by the outcome. He mentioned that such early motions against a government agency are typically denied, reiterating that the goal is to seek clarity through legal proceedings.

The case now moves forward to discovery, with Judge Failla instructing both parties to submit proposed case management plans by April 19. The ruling today reinforces the SEC’s regulatory oversight regarding crypto-related activities.

Implications for the Crypto Industry

While Failla’s ruling could indicate challenges for Coinbase, it also raises concerns for the broader crypto industry’s ongoing interactions with federal regulators. The rejection of Coinbase’s claim that the SEC violated federal law by not disclosing its crypto policy underscores the importance of regulatory compliance within the industry.

Judge Failla made it clear that the SEC’s analysis of crypto transactions is based on existing standards and not a new regulatory policy. This aspect of her ruling signifies the need for industry players to adhere to established regulatory frameworks when engaging in crypto-related activities.

Image/Photo credit: source url