Analysis of Recent Bitcoin ETF Inflows

Farside data recently published revealed a significant $203.0 million net inflow on April 5th, marking the fourth consecutive day of positive movement for Bitcoin ETFs. This trend indicates a growing interest and confidence in the digital asset space among investors. Notably, BlackRock’s IBIT ETF stood out with a substantial net inflow of $308.8 million on the same day, bringing its cumulative total net inflow to an impressive $14,769.1 billion. This surge represents the largest net inflow day for IBIT since March 27th, highlighting the fund’s increasing dominance in the market.

On the other hand, Fidelity’s FBTC also experienced a healthy $83.0 million net inflow, contributing to its overall net inflow of $7,957.6 billion. In contrast, Grayscale’s GBTC witnessed significant outflows amounting to $198.9 million, the largest since April 1st, resulting in a total outflow of $15,505.3 billion, according to Farside reports.

Breakdown of Bitcoin Holdings

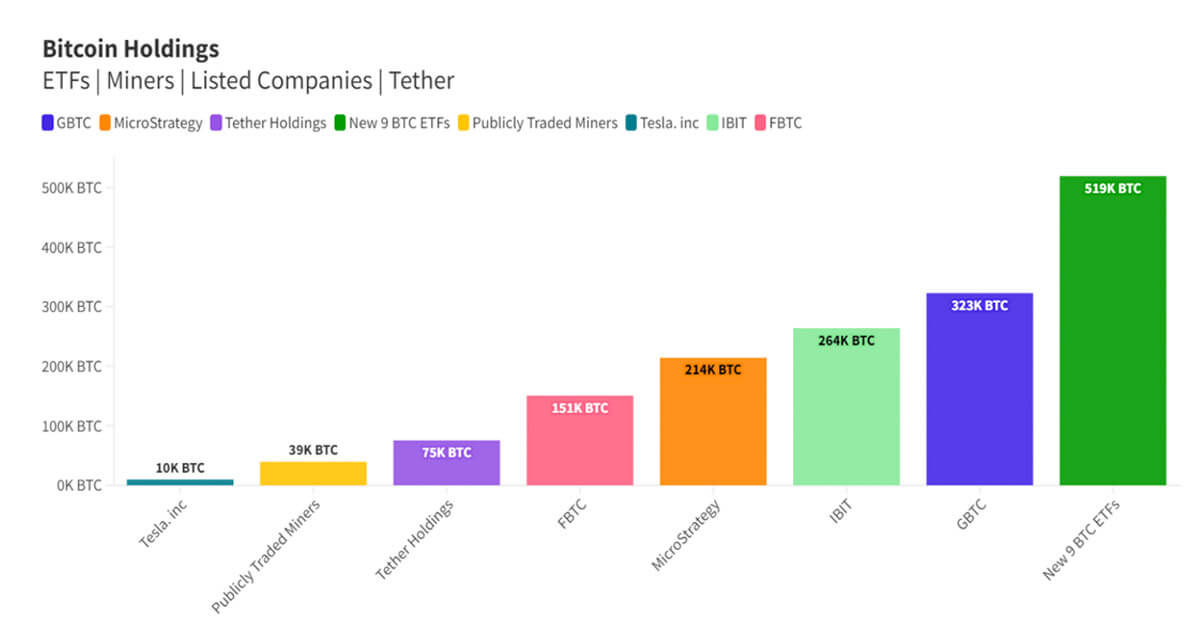

Additional data from Heyappolo shows that GBTC currently holds 323,000 Bitcoin, while IBIT has accumulated 264,000 Bitcoin, and FBTC holds 151,000 Bitcoin. Interestingly, the introduction of 9 new Bitcoin ETFs, excluding GBTC, has collectively amassed 519,000 Bitcoin, reflecting a diversification of holdings within the ETF market.

Overall, the influx of investments into BlackRock’s IBIT ETF nearing the $15 billion mark demonstrates a growing confidence among investors in the digital asset sector. With the continued positive momentum in Bitcoin ETF inflows, the market dynamics are evolving, paving the way for further growth and opportunities in the cryptocurrency space.

Image/Photo credit: source url