Eli Lilly Stock Surges After Strong Performance of Weight Loss Drug

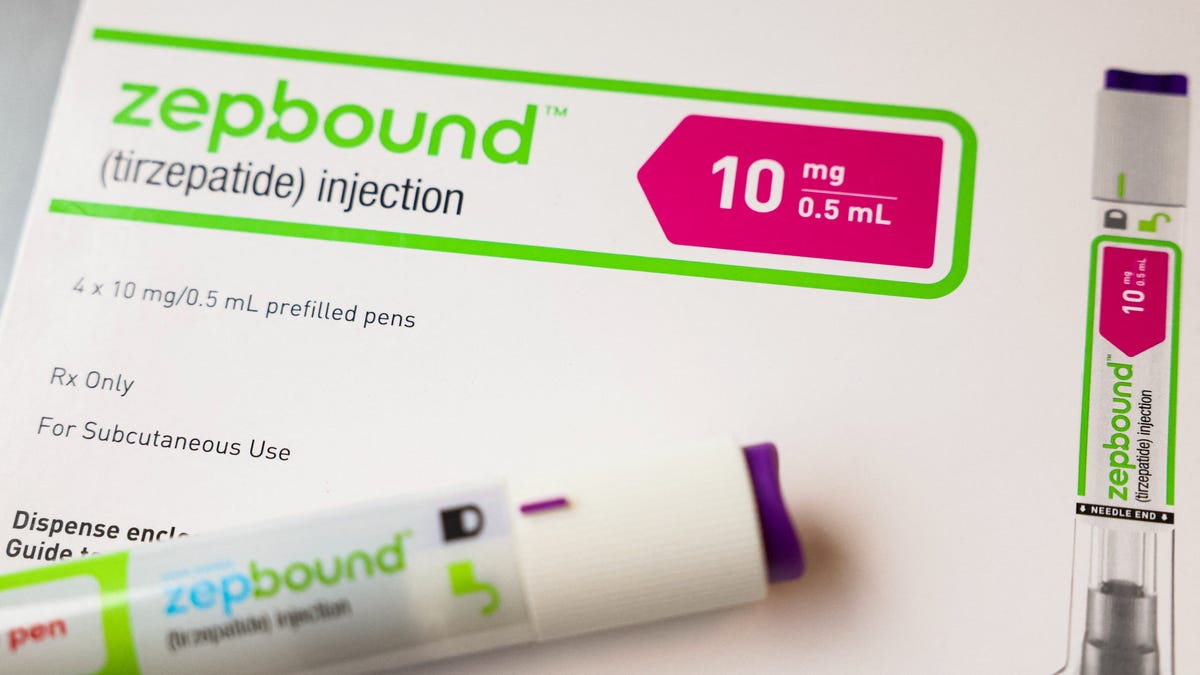

Eli Lilly’s stock jumped 5% during Tuesday morning trading to about $773 a share after the pharmaceutical giant reported better-than-expected sales of its weight loss drug Zepbound in the first quarter of 2024.

Strong Revenue Growth and Market Outlook

CEO David A. Ricks highlighted Lilly’s solid year-over-year revenue growth in the first quarter, driven by strong sales of Mounjaro and Zepbound. The company’s revenue grew by 26% year over year, primarily due to the success of its diabetes and weight loss drugs Mounjaro and Zepbound. These medications belong to the same class of medication as Ozempic and Wegovy, produced by rival Novo Nordisk. Analysts from Morgan Stanley project that the GLP-1 agonists or incretins market, including drugs like Mounjaro and Zepbound, will reach $105 billion by 2030.

In the first three months of 2024, Zepbound generated $517.4 million, surpassing Wall Street’s expectations of $373 million in sales by FactSet. Sales of Mounjaro during the same period reached $1.8 billion, marking a significant achievement for Eli Lilly.

Supply Challenges and Future Growth

The FDA announced that most doses of the incretin medications will face limited availability through the end of June due to increased demand. Ricks addressed the shortages by emphasizing the company’s efforts to expand manufacturing capacity rapidly to make these vital medicines accessible to more patients.

Eli Lilly increased its full-year revenue guidance for 2024 by $2 billion, now ranging between $42.4 billion to $43.6 billion. This adjustment is attributed to the robust performance of the medications and the ongoing expansion of the company’s production capabilities. Over the past two years, Eli Lilly has invested at least $3 billion in new manufacturing facilities to support its growth strategy.

Financial Performance Overview

- 67% Net Income Increase: Eli Lilly’s net income rose to $2.2 billion in the first quarter of 2024, a 67% increase from $1.3 billion in the same period last year.

- 26% Total Sales Growth: The company’s total sales climbed by 26% year over year in the first quarter of 2024, reaching $8.8 billion from $6.9 billion.

- $2.58 Earnings Per Share: Eli Lilly exceeded analysts’ estimates of $2.47 with its earnings per share of $2.58, as reported by FactSet.

This strong financial performance and outlook position Eli Lilly as a key player in the pharmaceutical industry, showcasing its ability to innovate, respond to market demands, and drive growth through strategic investments in research, development, and manufacturing.

Image/Photo credit: source url