Analysis of the Impact of Grayscale GBTC Sell-Off on Bitcoin Long-Term Holder Metrics

The recent sell-off from Grayscale has introduced a fascinating twist to well-known Bitcoin metrics, leading to a distortion of data as the cryptocurrency heads towards its next halving event. One particularly intriguing metric to examine in this context is the duration since bitcoins were last transacted on-chain, a parameter commonly referred to as the “Supply Last Active” (SLA) period, which can range from 1 year or more to 5 years or more. Historically, this metric has served as a valuable tool in assessing market cycles. However, the current scenario is marked by a significant departure from past trends due to the outflows from Grayscale impacting wallets that have long remained inactive.

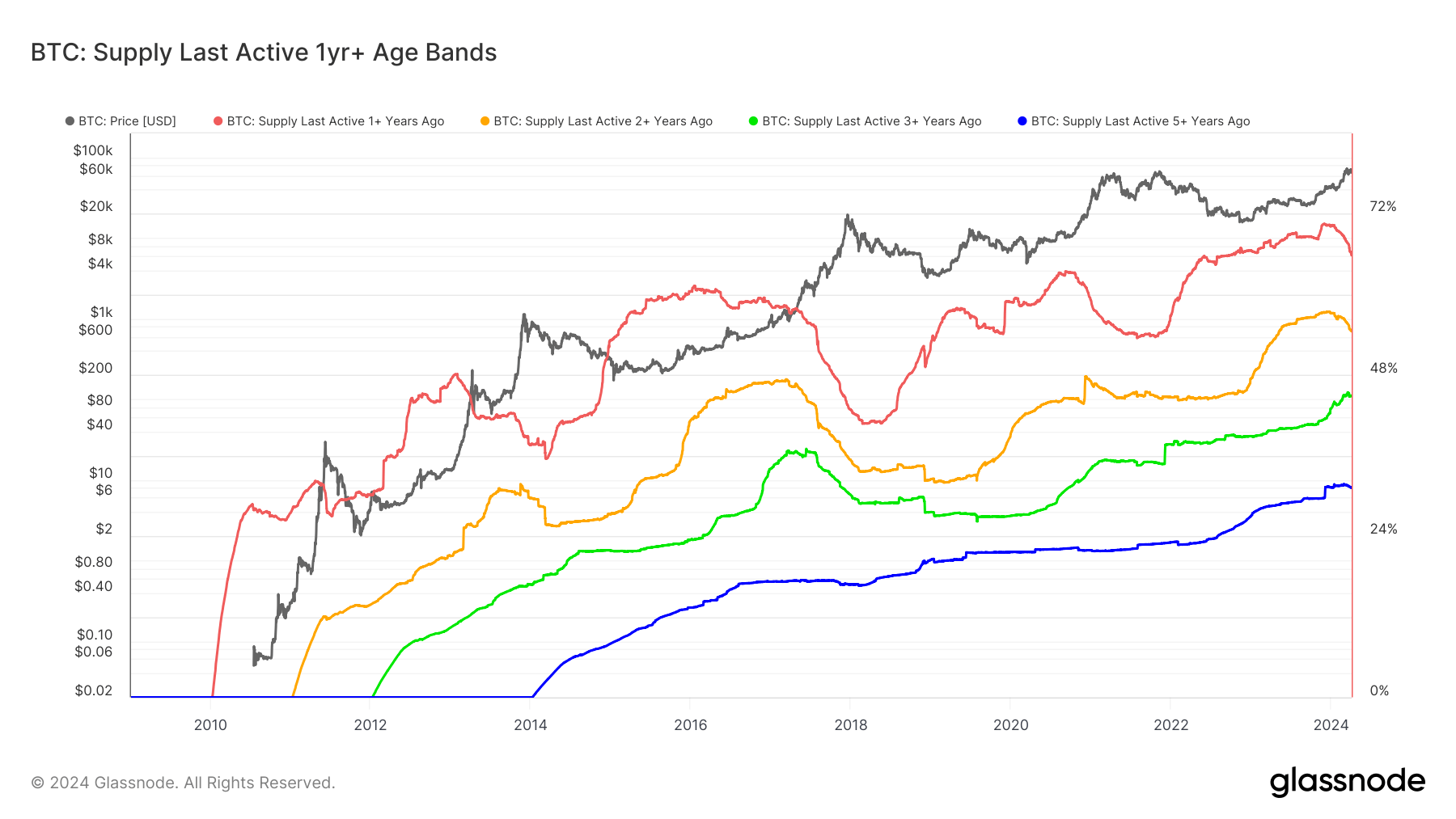

Visual representations provided by Glassnode showcase an overlay of various SLA categories as a percentage of the circulating supply. Typically, as coins are held by long-term investors, these metrics show an upward trajectory. Conversely, when such investors decide to divest their holdings, the metrics witness a decline as older coins change hands.

Throughout Bitcoin’s history, long-term holders (LTH) holding assets for periods exceeding 155 days have often chosen to liquidate their holdings during bullish phases, seizing the opportunity to capitalize on gains accumulated during bearish spells. With Bitcoin recently reaching unprecedented highs, all SLA categories have experienced a drop from their previous peak levels.

However, it is crucial to factor in the impact of the Grayscale Bitcoin Trust (GBTC) selling approximately 300,000 BTC. Investors who have acquired GBTC, particularly during periods of discount in recent years, are classified as long-term holders. This classification introduces a confounding variable into the data analysis due to the outflows from GBTC.

An examination of the LTH net position change reveals a current sell-off intensity reminiscent of similar occurrences during the peaks of 2013, 2017, and 2021. Despite these observations, the prevailing market sentiment does not currently imply a peak, especially with the halving event expected to take place in roughly 15 days.

Image/Photo credit: source url