Analyzing MicroStrategy’s Stock Performance

MicroStrategy (MSTR), a prominent business intelligence firm known for its extensive Bitcoin investments, recently witnessed a substantial decline in its share price, plummeting by more than 11% on March 28. The company’s shares are currently valued at $1,704, a stark deviation from the projected $2,000 threshold previously highlighted by CryptoSlate. Nonetheless, despite this setback, MicroStrategy’s year-to-date performance remains commendable, boasting an impressive 150% increase.

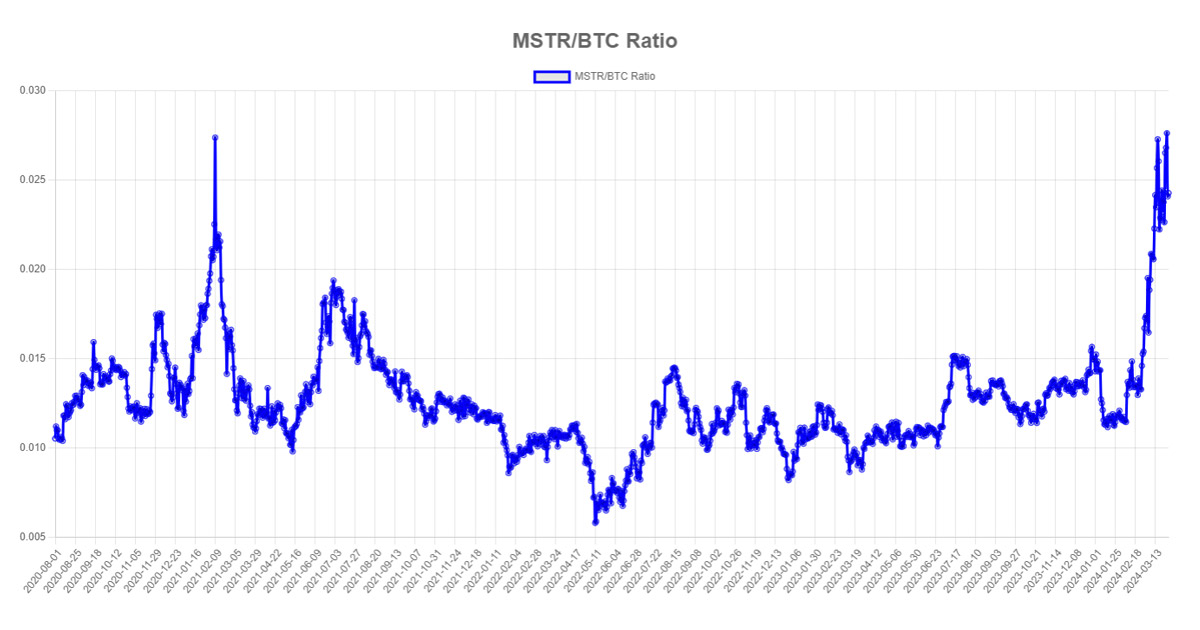

Monitoring the MSTR/BTC Ratio

Analysts maintain a keen focus on the “MSTR/BTC Ratio,” a metric that compares MicroStrategy’s stock price to the price of Bitcoin. This ratio offers insights into how the company’s stock valuation correlates with Bitcoin’s market movements. Presently standing at 0.024, the ratio recently peaked at 0.028, reminiscent of levels observed in June 2021 at approximately 0.027, as reported by mstr-tracker.

Examining the NAV Premium

The “NAV Premium” chart, as provided by mstr-tracker, showcases the premium associated with MicroStrategy’s stock relative to its proxy-NAV in Bitcoin. This chart reveals that the market values the company’s stock at 1.92 times its Bitcoin holdings. The methodology employed by the site to determine an equivalent NAV for MicroStrategy incorporates factors such as its Bitcoin assets, outstanding shares, share price, and market capitalization. Notably, the current NAV figure aligns with the peak recorded in June 2021, when MicroStrategy’s share price oscillated between $500-$600, and Bitcoin traded at around $35,000.

Image/Photo credit: source url