Market Sentiment and Investment Considerations

On the initial day of the second quarter, market sentiment exhibited a blend of optimism and caution among investors. A notable development was the modest growth of 0.3% in the Personal Consumption Expenditures (PCE) price index, signaling a potential path for rate cuts by the Federal Reserve in the upcoming months. While the Fed Chair displayed a composed approach towards implementing rate reductions, Treasury yields surged subsequent to the data release. Particularly, the benchmark 10-year Treasury yield observed a significant uptick of more than 11 basis points, standing at 4.303%.

Exploring the Viability of Bitcoin as a Speculative Investment

The realm of digital assets sparked contemplation regarding the suitability of Bitcoin as a speculative investment. Against the backdrop of a relatively stable stock market, exemplified by virtually unchanged stock market indices, uncertainty loomed. The Dow recorded a decline of 263 points, equivalent to a 0.6% decrease, settling at 39,543. Correspondingly, the S&P 500 and Nasdaq experienced marginal drops of 0.2% and 0.03% respectively, reflecting the equivocal sentiments prevailing among investors.

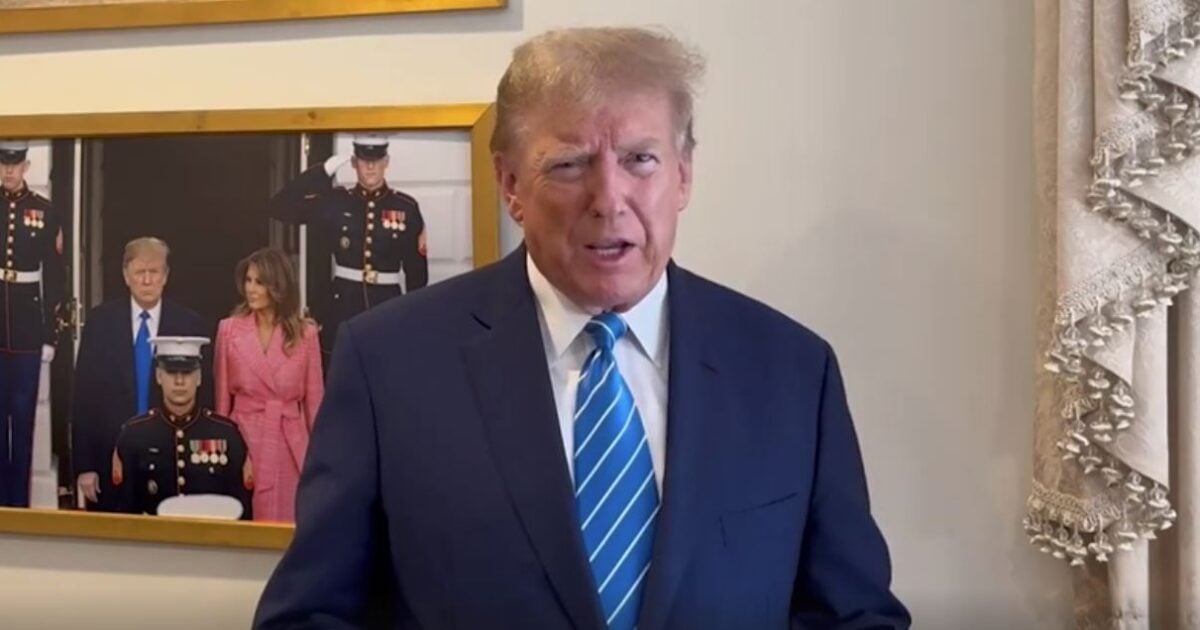

Trump Media & Technology Group Under Scrutiny

Amidst the market dynamics, Trump Media & Technology Group, spearheaded by former President Donald Trump, encountered a substantial setback. Notably, the company’s shares witnessed a drastic plunge exceeding 25% following the revelation of substantial losses incurred in 2023. The company, recognized for its social media platform Truth Social, divulged operational losses nearing $16 million, combined with interest expenditures amounting to $39.4 million, against a meager revenue generation of $4.1 million, as disclosed in a filing submitted to the Securities and Exchange Commission. Comparatively, the company’s dismal financial performance in 2022 underscores a recurring pattern of operational deficits, interest charges, and constrained revenue, accentuating the prevailing challenges faced by the organization.

Airline Industry Turbulence and Strategic Responses

The aviation sector encountered turbulence as multiple airline stocks witnessed downturns on Monday morning. United Airlines, grappling with delays from Boeing, resorted to soliciting unpaid leave from pilots for the upcoming month, triggering a 0.2% decline in its stock value. Concurrently, Boeing experienced a notable decline of 1.56%, while Southwest Airlines recorded a more marginal dip of 0.05%. These developments underscored the operational challenges and strategic adaptations essential for sustained growth and resilience in the aviation industry.

Walgreens Boots Alliance’s Strategic Realignment

Walgreens Boots Alliance delineated a strategic realignment strategy characterized by significant cost-cutting measures amounting to $1 billion, encompassing layoffs and store enhancements. Noteworthy was the recording of a substantial $5.8 billion impairment charge related to its investment in clinic operator VillageMD, signaling a recalibration of strategic priorities and financial commitments. The pronounced decline of 8% in Walgreens Boots Alliance’s stock value reflects the market’s response to these strategic developments and the imperative of prudent financial management in navigating dynamic market conditions.

Robust Performance of the US Manufacturing Sector

Conversely, a beacon of resilience emanated from the US manufacturing sector, showcasing robust performance not witnessed since 2022. The Institute for Supply Management’s manufacturing PMI served as a testament to this resurgence, marking a notable expansion in March, symbolizing a return to growth after a prolonged period of stagnation. This resurgence underscores the resilience and adaptability of the manufacturing sector amidst challenging economic landscapes and underscores the pivotal role played by this sector in driving economic growth and stability.

Upcoming Economic Indicators and Implications

Looking ahead, a key economic indicator in the form of the unemployment report is slated for release later this week, bearing profound implications for the economic landscape. The insights gleaned from this report are anticipated to inform the Federal Reserve’s deliberations on interest rate adjustments, underscoring the interconnectedness between macroeconomic indicators and monetary policy decisions. As market dynamics continue to evolve, the prudent assessment of economic data and policy implications remains integral to navigating the intricate financial landscape.

Image/Photo credit: source url