The Impact of US Inflation Data on Market Dynamics

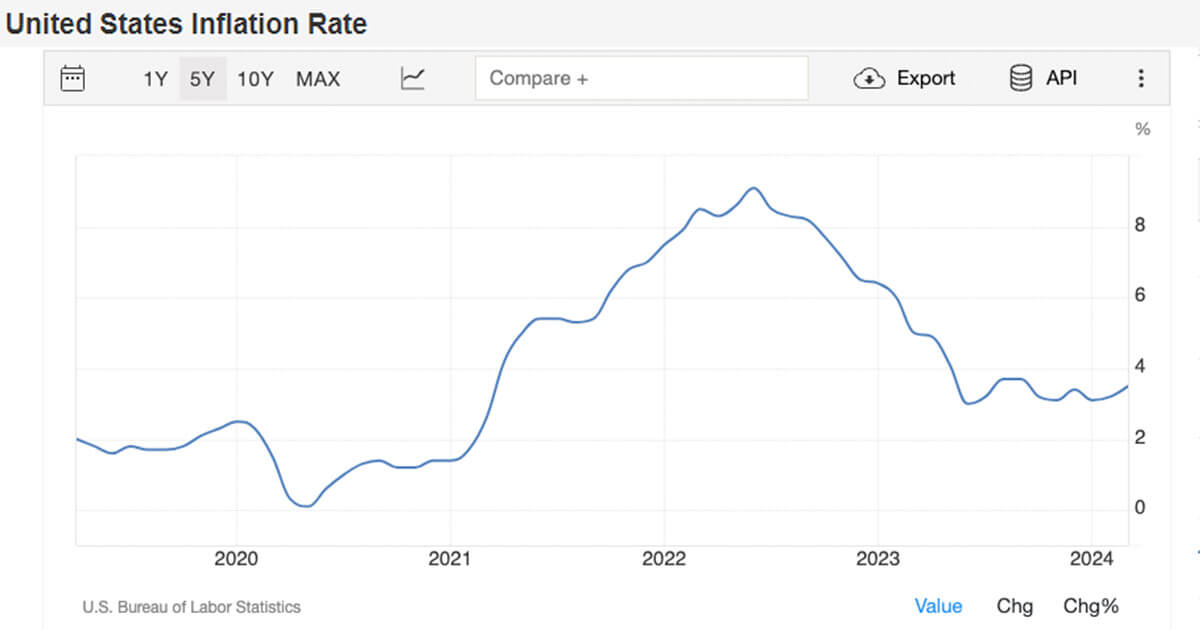

The most recent data on inflation in the United States has taken analysts by surprise, as the headline inflation year-over-year (YoY) figure has exceeded expectations, coming in at 3.5%. This unexpected development holds significant implications in light of the Federal Reserve’s current approach to monetary policy, characterized by one of the most vigorous hiking cycles in recent history.

According to insights from Statista, the Federal Reserve has embarked on this aggressive tightening cycle with the aim of curbing the rampant inflation that the central bank initially described as transitory in nature. Despite a temporary decline to 3% in June 2023, headline inflation has now risen to 3.5% over nine months, with current Fed funds rates fluctuating between 5.25% to 5.5%.

While core inflation has demonstrated relative stability, maintaining a position just below 4% since September 2023 as reported by Trading Economics, the response from the market has been notable. Notably, Bitcoin continues to be perceived as a risk-on asset, influenced by its derivative ties to the Nasdaq-100 Index (QQQ) as evidenced by its decline below $68,000 following the CPI news. However, there have been instances where Bitcoin has exhibited characteristics of a risk-off asset, a phenomenon observed during events like the Cyprus crisis.

Implications on Bond Yields and Foreign Exchange Markets

Furthermore, the inflation data has had reverberations in the bond market, with implications on bond yields. Specifically, the front end of the treasury curve (3 and 6 months) is now indicating no potential rate cuts until at least Q3. This shift in market dynamics has also been reflected in the performance of the DXY index, which has surged above 105, and the USDJPY pair, which has broken the 152 level for the first time since 1990.

This significant movement in foreign exchange rates raises the possibility of the Bank of Japan taking action to raise interest rates in an effort to fortify the weakened currency and address concerns related to the yen carry trade.

Overall, the interplay between inflation data and its impact on various asset classes underscores the nuanced nature of market dynamics, highlighting the need for adaptability and a comprehensive understanding of economic indicators in navigating financial landscapes.

Image/Photo credit: source url