Historic Achievement for Tether

Stablecoin giant Tether (USDT) has marked a significant milestone by recording a historic net profit of $4.52 billion in the first quarter of this year, despite facing challenges in market share.

Record-Breaking Profits

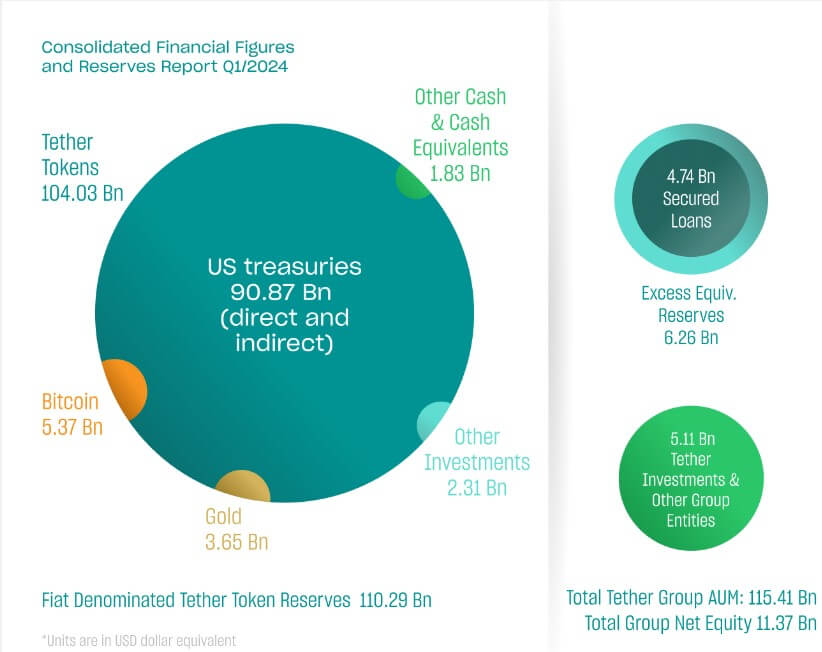

An attestation report shared with the industry publication CryptoSlate revealed that Tether’s profits were primarily generated from its investments in US Treasury holdings, supplemented by gains from Bitcoin and gold investments. Tether CEO, Paolo Ardoino, highlighted the company’s commitment to transparency, stability, liquidity, and responsible risk management.

“Tether has demonstrated its unwavering commitment to transparency, stability, liquidity, and responsible risk management. As shown in this latest report, Tether continues to shatter records with a new profit benchmark of $4.52 billion, reflecting the company’s sheer financial strength and stability.”

As of March 31, 2024, Tether’s treasury portfolio exceeded $90 billion in US Treasury bills, including direct and indirect holdings. This resulted in a surplus reserve increase of $1 billion, amounting to nearly $6.3 billion. Additionally, Tether Group’s equity saw a notable surge to $11.37 billion, up from $7.01 billion reported at the close of 2023.

The report confirmed that Tether-issued stablecoins remained backed by 90% reserve, comprising assets such as cash and cash equivalents, maintaining consistency with the previous quarter’s figures. Tether’s token reserves stood at approximately $110.3 billion, with liabilities totaling around $104 billion, showcasing a surplus of over $6 billion.

Challenges in Market Share

Despite minting $12.5 billion in new USDT tokens during the first quarter, Tether is facing a decline in market share due to intensified competition in the stablecoin arena. Data from Kaiko indicated a decrease in Tether’s market share on centralized exchanges (CEXs) to 69% year-to-date.

The stablecoin faced fierce competition from alternatives like FDUSD, which leveraged Binance’s zero-fee promotions, while USDC, backed by Circle, saw a rise in market share to 11%. This shift suggests a growing preference for regulated stablecoin options. Additionally, the popularity of yield-bearing alternatives such as Ethena’s USDe has impacted Tether’s dominance in the market.

Following its launch in February, USDe experienced significant trading volume growth, although it dipped from its peak in April after Ethena’s ENA airdrop. These developments highlight the evolving dynamics within the stablecoin market, where competition and innovation are reshaping the landscape.

Image/Photo credit: source url