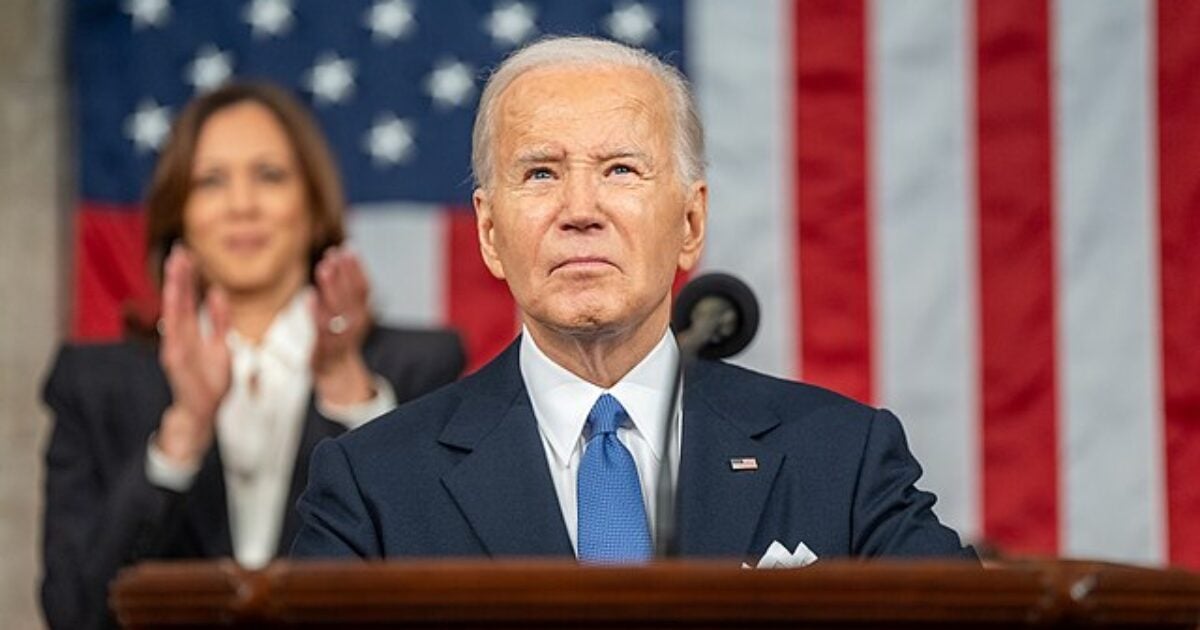

President Biden’s State of the Union Address: A Critical Analysis

President Joe Biden delivered his State of the Union address to a joint session of Congress in the House Chamber at the U.S. Capitol on March 7, 2024. During his speech, he expressed deep concerns about redistributing money from working Americans to non-working and non-taxpaying individuals, whether foreign or domestic.

Biden’s primary focus seems to be on increasing revenue from high-income individuals and households. In his address, he proposed a 25% tax on America’s billionaire households, highlighting the disparity in taxation rates compared to the average American worker. However, this proposal raises significant questions about its impact on the economy and the principles of fair taxation.

Wealth Vs. Income Taxation

One of the contentious issues arising from Biden’s proposal is the distinction between wealth and income taxation. While the current top income tax rate stands at 37%, targeted at high-income individuals, the new tax plan appears to target accumulated wealth rather than income. This subtle difference challenges the traditional concept of income tax and raises concerns about its fairness and legality.

Moreover, Biden’s claim that individuals earning less than $400,000 will not face additional federal taxes under his plan contradicts the fundamental principles of progressive taxation. By proposing a lower tax rate for individuals earning more than $400,000 based on wealth rather than income, the President’s plan lacks coherence and transparency.

The Flawed Basis of Taxation

A 2021 White House study highlighted the discrepancy in tax rates paid by the wealthiest families, with an average income tax rate of 8%. Biden’s speech reiterated this statistic, portraying billionaires as undertaxed compared to the average citizen. However, the study’s inclusion of unrealized capital gains as income raises critical concerns about the accuracy and validity of its findings.

The taxation of unrealized capital gains and the proposal to tax appreciation on assets pose significant challenges to the current tax system. Implementing annual appraisals of assets for tax calculation purposes could lead to financial burdens and complexities for taxpayers. This approach calls into question the feasibility and ethics of taxing potential gains rather than realized income.

Economic Implications and Policy Considerations

Biden’s plan to provide a $400 monthly tax credit for first-time homebuyers and address antitrust issues in the housing market reflects his administration’s commitment to housing affordability. However, the unintended consequences of such policies, such as increased demand leading to price inflation and government intervention impacting rental markets, raise concerns about long-term economic stability.

The President’s emphasis on taxing the wealthy, supporting homebuyers, and regulating landlords through antitrust measures underscores his administration’s priorities. Nevertheless, the repercussions of these policies on working Americans, homeowners, and renters remain uncertain, prompting a critical examination of their implications for economic growth and equity.

In conclusion, President Biden’s State of the Union address reveals a complex interplay of tax policies, economic strategies, and social objectives. As the nation navigates these proposed changes, assessing the rationale, feasibility, and impacts of such initiatives becomes essential for informed decision-making and policy formulation.

Image/Photo credit: source url