Bitcoin Halving Sparks Surge in Miner Fees

The Bitcoin halving event that took place on April 20 had a significant impact on miner fees in the cryptocurrency ecosystem. One of the key catalysts for this surge in fees was the introduction of a new feature known as Runes, which garnered a considerable amount of attention from users.

Initially, Runes quickly rose to prominence within the network, accounting for a substantial portion of the total transaction volume. In fact, on April 23, Runes transactions accounted for over 750,000 transactions, representing approximately 73% of all transactions during that time period.

Shift in Transaction Volume Trends

However, data from Dune Analytics indicates that in the days following the halving event, there was a gradual decline in the volume of Runes transactions. By April 25, Bitcoin on-chain transactions had overtaken Runes transactions, comprising around 75% of the total transaction fees, while Runes accounted for only about 22%.

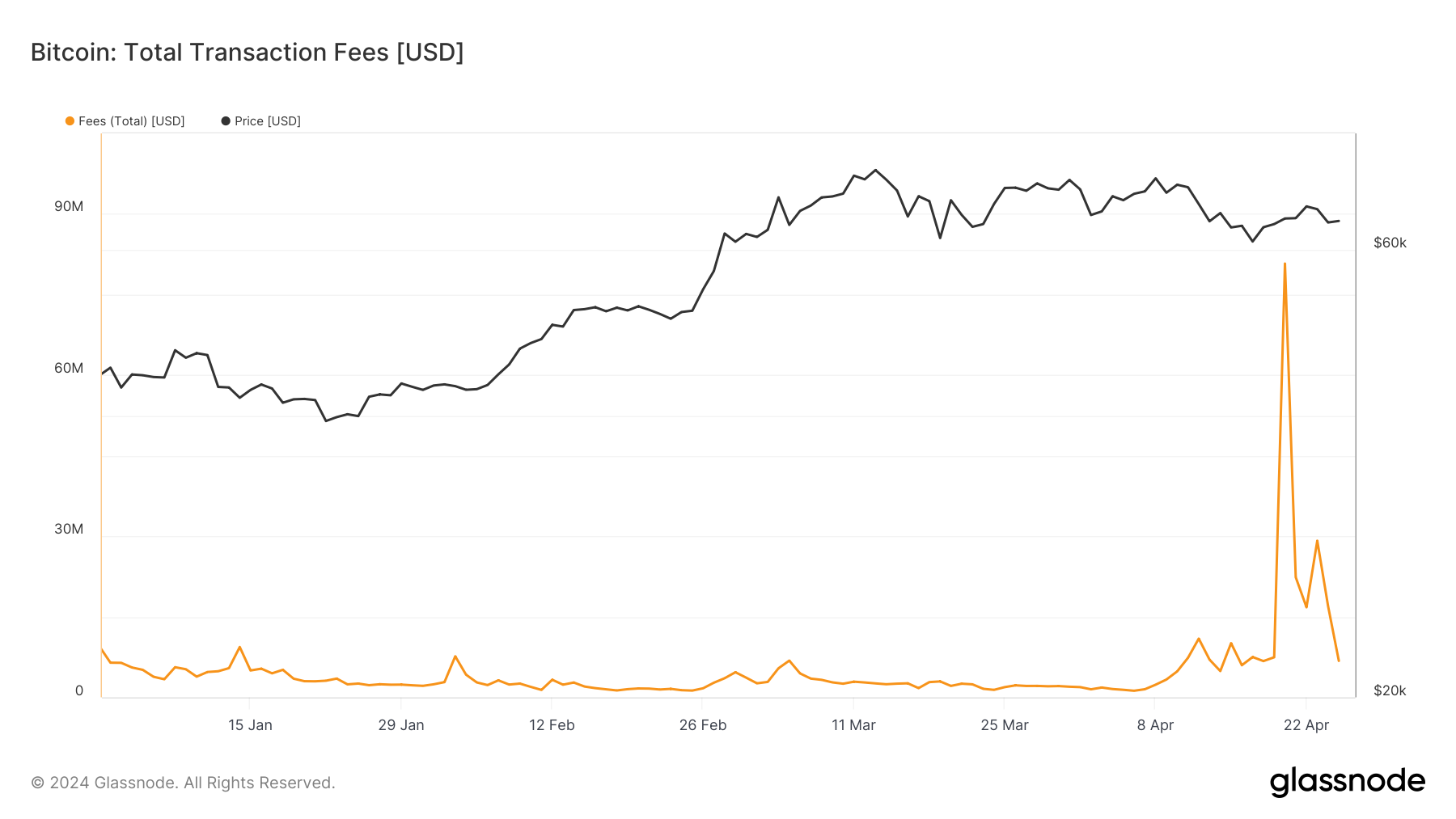

Glassnode data further corroborates this trend, showing that fees have returned to pre-halving levels. This indicates a potential shift in the significance of Runes in fee distribution, with Bitcoin network fees on April 25 amounting to approximately $6.7 million, similar to levels seen before the halving event.

Decrease in Transactions with Runes

Previous analysis conducted by CryptoSlate also revealed a noticeable decrease in transactions involving Runes since its launch in 2023, pointing to a potential downward trend for this feature.

Another factor that may have contributed to the decline in fees following the halving is the ongoing Bitcoin difficulty epoch. Current data suggests that the difficulty adjustment rate is hovering around 1%, which could impact the overall network dynamics.

Despite the diminishing fees and changing transaction trends, one question that remains unanswered is whether the hash rate will continue to increase in the coming days and weeks. This ongoing evolution in the cryptocurrency landscape underscores the importance of monitoring and analyzing key metrics to glean insights into the market’s future trajectory.

Image/Photo credit: source url