Reflections on Bitcoin Through Significant Events

As the Bitcoin halving approaches, it is imperative to reflect on the transformative events that have unfolded since the previous halving in May 2020. These events have not only shaped the economic landscape but have also influenced the widespread adoption of Bitcoin.

Impact of the COVID-19 Pandemic

The onset of the COVID-19 pandemic in March 2020 had a profound impact on the global economy during the entire halving cycle. The aftermath of the pandemic resulted in severe inflation and currency debasement, effects that continue to reverberate today.

Corporate Adoption and Regulatory Changes

In August 2020, Michael Saylor, the then CEO of MicroStrategy, made a bold move by embracing Bitcoin, leading the company to accumulate more than 1% of the total Bitcoin supply by April 2024. Additionally, the Financial Accounting Standards Board (FASB) introduced regulations that will facilitate corporate adoption by implementing fair value accounting for Bitcoin in corporate treasuries.

Furthermore, El Salvador made history by legalizing Bitcoin as a form of tender and adopting a dollar-cost averaging (DCA) strategy for acquiring the digital asset.

Geopolitical Tensions and Technological Advancements

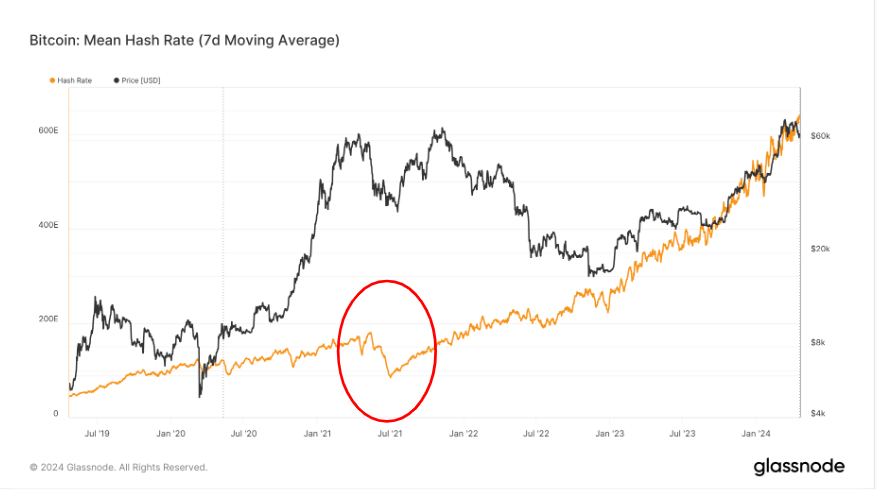

In the summer of 2021, China’s ban on Bitcoin resulted in a significant drop in the hash rate, plummeting by approximately 50%. Geopolitical tensions escalated with various conflicts, including Russia’s invasion of Ukraine in February 2022 and recent conflicts in the Middle East.

The introduction of Bitcoin ordinals paved the way for the launch of Runes at block 840,000, marking a significant technological advancement in the cryptocurrency space.

Market Developments and Resilience

During this halving cycle, the balance of Bitcoin on exchanges decreased for the first time, signaling a shift in investor behavior. Additionally, the digital asset exchange FTX and several crypto lending platforms like Celsius and BlockFi faced challenges.

Notable market events in January 2024 included the successful launch of Bitcoin ETFs, consolidating Bitcoin’s position within the financial realm. Despite facing obstacles such as high inflation rates and geopolitical turmoil, Bitcoin has demonstrated remarkable resilience by surging 577% since the last halving.

As we navigate through uncertain times, the finite supply of 21 million Bitcoin serves as a constant reminder of the digital currency’s enduring value and potential amidst unprecedented challenges.

Image/Photo credit: source url