The Dow Jones Industrial Average’s Surge

The Dow Jones Industrial average experienced a significant surge of more than 450 points on Monday afternoon, closing up 253 points. This surge occurred despite the ongoing challenges faced by Tesla, particularly after Elon Musk’s electric vehicle manufacturer laid off over 10% of its workforce and slashed prices globally. The stock for Tesla continued to slide as investors awaited the closely watched earnings report scheduled for Tuesday.

Positive Performance in Tech Stocks

Amidst this backdrop, there were some positive developments in the tech sector. TSMC, the Taiwanese semiconductor company, exceeded Q2 sales expectations driven by the booming demand for artificial intelligence (AI) technology, particularly from companies like Nvidia and Apple. Nvidia, in particular, made a remarkable recovery from the previous week’s steep decline and emerged as one of the top performers on Monday. Other tech giants such as Amazon and Salesforce also saw their stock prices rise.

Additionally, crypto-related stocks experienced a surge following the Bitcoin “halving” event. Companies like MicroStrategy and Coinbase witnessed significant gains, reflecting the increased interest in the cryptocurrency market.

Upcoming Earnings Reports

Several companies are gearing up to report their earnings during this busy week, including tech behemoths like Microsoft, Meta (formerly known as Facebook), and Alphabet, Google’s parent company. These reports are expected to provide insights into the current financial landscape and market trends.

Interestingly, while the overall market showed positive momentum, the Federal Reserve opted to hold off on cutting interest rates, citing concerns about elevated inflation levels. This decision underscored the challenges posed by the current economic environment.

By the end of the trading day, the Dow had gained 254 points, representing a 0.6% increase to reach 38,240. The Nasdaq and S&P 500 also recorded gains of 1.1% and 0.8%, respectively.

Tesla’s Pricing Strategy and Stock Performance

Tesla’s stock faced downward pressure as Elon Musk implemented price cuts in key markets such as China, Germany, and the U.S. These price adjustments were aimed at reviving demand for electric vehicles ahead of the company’s upcoming earnings announcement. Tesla recently reported a decline in sales compared to the previous year, particularly in its Model 3 cars and SUVs, leading to the need for strategic price changes to align production with market demand.

Elon Musk highlighted the necessity for frequent price modifications to maintain a balance between supply and demand, emphasizing the dynamic nature of Tesla’s pricing strategy. Moreover, the company underwent significant workforce reductions, impacting more employees than initially estimated.

As a result, Tesla’s stock experienced a 3.4% decline by the end of the trading day, adding to its year-to-date decrease of over 42%, positioning it as one of the underperforming stocks in the S&P 500 index.

Nvidia’s Recovery and Super Micro Computer’s Challenges

Following a recent announcement by Super Micro Computer regarding its earnings pre-announcement status, the company witnessed a sharp decline in its stock value, triggering a negative trend for AI-related stocks, including Nvidia and Micron Technology. However, Nvidia managed to recover from the previous day’s losses, emerging as one of the top performers within the S&P 500, with a gain of approximately 4.3% by the market close.

On the other hand, Super Micro Computer faced ongoing challenges, albeit experiencing a slight recovery in the late afternoon trading session.

Cryptocurrency Stocks Surge Post Bitcoin ‘Halving’

Bitcoin’s successful “halving” event over the weekend triggered a surge in cryptocurrency-related stocks. As Bitcoin traded at $66,000, several companies, including MicroStrategy, witnessed substantial stock value appreciation. MicroStrategy, known for its significant holdings of Bitcoin, recorded a 12.7% increase by the end of the trading day, signaling strong investor interest in the crypto market.

Furthermore, the company is anticipated to make additional Bitcoin purchases in the near future, aligning with its bullish outlook on the digital currency.

Verizon and AT&T Earnings Performance

Verizon recently released its earnings report, which showed a slight increase in revenue but fell short of Wall Street expectations. The wireless carrier’s net income for the first quarter was $4.72 billion, or $1.09 per share, lower than the previous year’s figures. Despite this, the company’s stock witnessed a 4.6% decline after the markets closed, positioning it as one of the notable losers in the S&P 500 index.

Similarly, AT&T’s stock also experienced a 1.2% drop, reflecting the broader challenges faced by telecom companies in a competitive market environment.

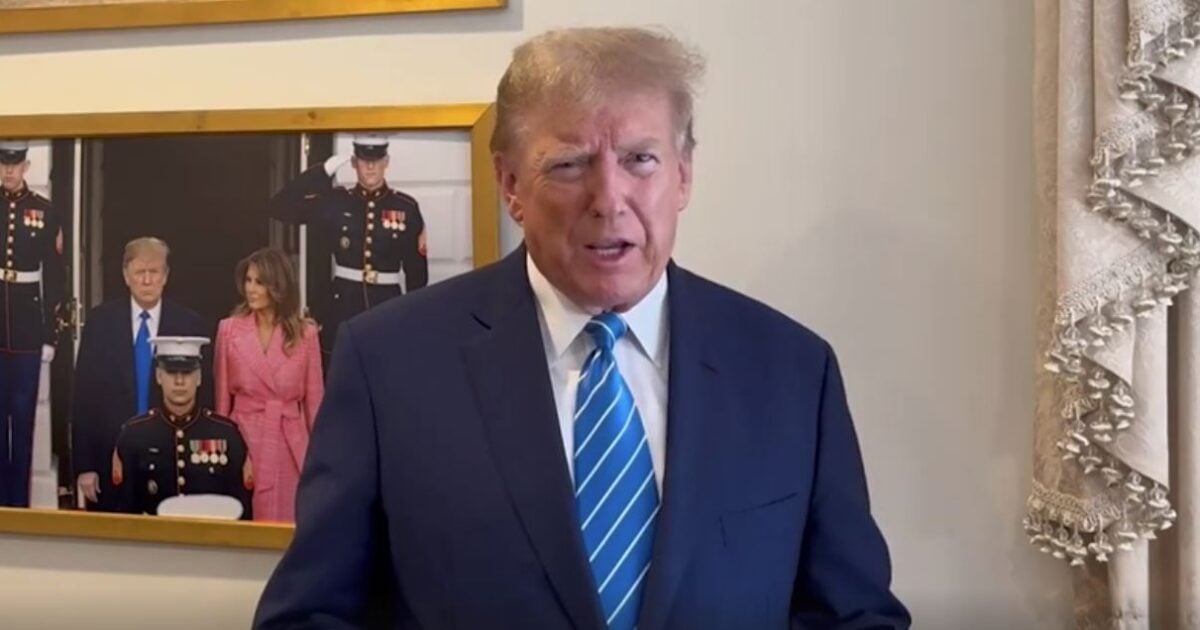

Image/Photo credit: source url