The Resilience of Gold Amid Market Volatility

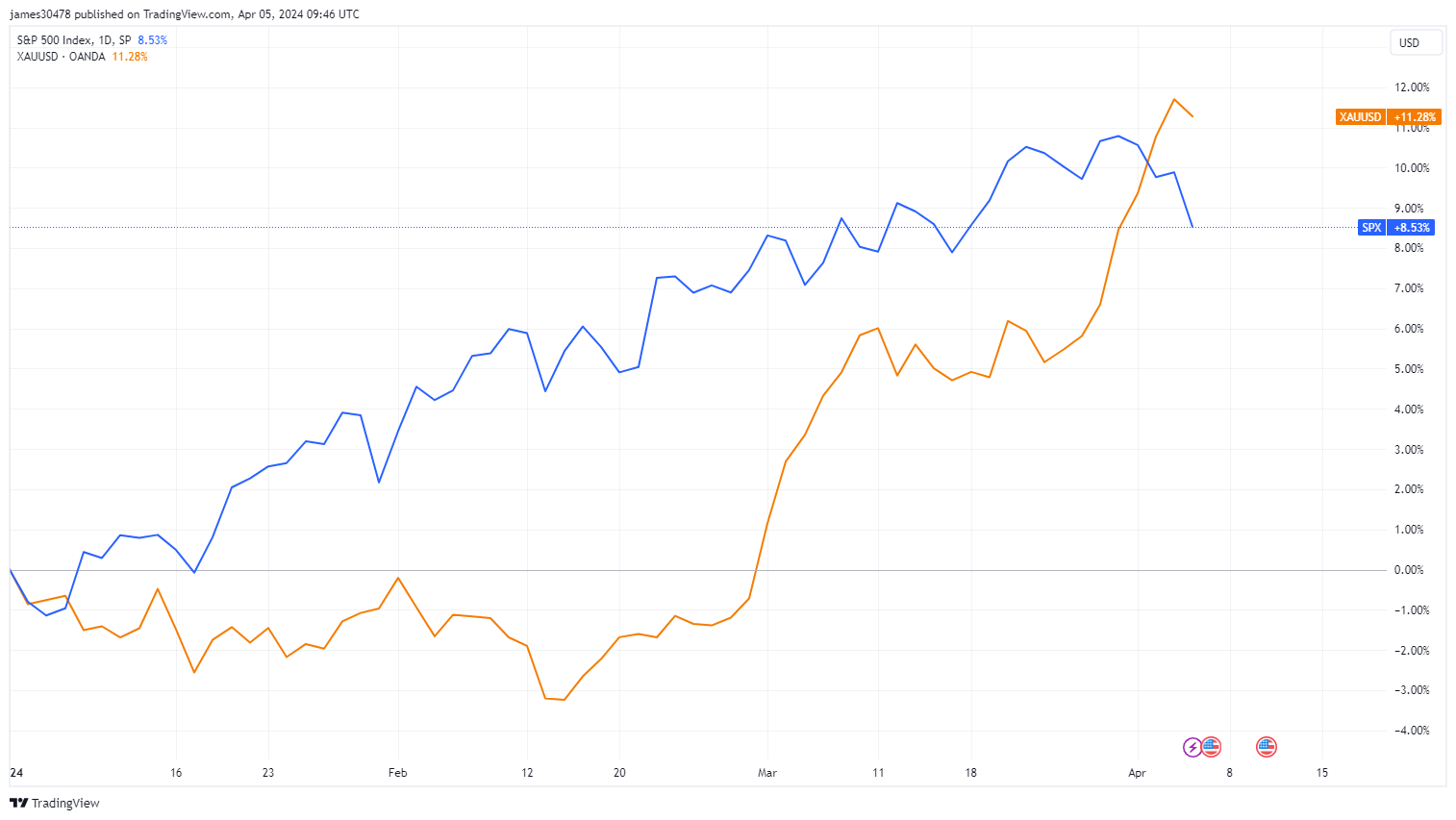

Gold has displayed remarkable resilience in the face of market volatility, outpacing the broader equity market in 2024. With a significant 11% rise compared to the S&P 500’s 9% gain, gold has once again proven its value as a safe haven asset during times of economic uncertainty.

A Historical Perspective

Over the past 70-80 years, the relative performance of the S&P 500 and gold has ebbed and flowed, with each asset class asserting its dominance at different points in time. This long-term trend underscores gold’s historical role as a hedge against economic instability and serves as a testament to its enduring value.

Gold’s ability to outperform the S&P 500 during periods of uncertainty is well-documented, with notable examples such as the years spanning from 1972 to 1996, which encompassed multiple recessions, as well as the aftermath of the 2008 financial crisis.

Macroeconomic Factors Driving Gold’s Performance

Several macroeconomic factors are likely contributing to gold’s current robust performance. Data from the Federal Reserve Economic Data (FRED) indicates that the United States is grappling with sizable deficits, with total public debt exceeding 120% of GDP in Q4 2023. Additionally, rising commodity prices and ongoing global conflicts hint at a potential inflationary rebound.

Furthermore, with the federal funds rate hovering between 5.25-5.50%, companies may face increasing challenges in servicing their debt in the coming year. Despite expectations of a rate cut being deferred, the short-term treasury market is not pricing in a cut within the next six months, as yields on 3-month and 6-month treasury securities remain higher than the Effective Federal Funds Rate (EFFR).

The Rise of “Digital Gold”

Interestingly, Bitcoin, often referred to as “digital gold,” has witnessed a remarkable surge of over 50% year-to-date. Should this digital asset sustain its rally post-halving, it would further solidify its narrative as a hedge against economic uncertainty, alongside traditional assets like gold.

As investors navigate an environment of heightened volatility and economic uncertainty, gold’s enduring strength as a safe haven asset is once again coming to the forefront, offering stability and protection in turbulent times.

Image/Photo credit: source url