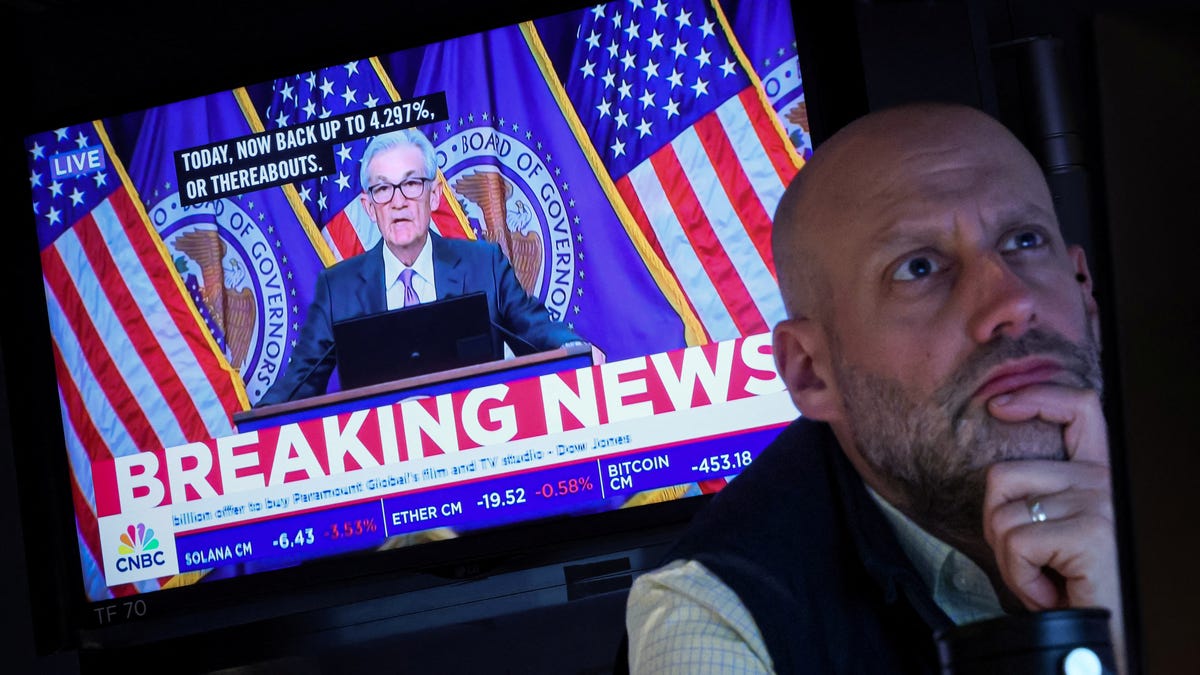

Market Update: U.S. Stock Indexes Continue to Fluctuate

Investors have been on edge as U.S. stock indexes experienced continued volatility on Wednesday morning. The Dow Jones Industrial Average saw a modest increase of 0.3% to reach 39,290. Meanwhile,, the Nasdaq Composite and the S&P 500 saw slight gains of 0.1% and 0.2%, respectively. All eyes in the financial world were eagerly awaiting Federal Reserve Chair Jerome Powell’s midday speech, which was set to address the topics of inflation and interest rates.

Financial Struggles for Retailers

Amidst the market turbulence, retail company Express is facing significant financial challenges, with reports suggesting that bankruptcy could be imminent. According to sources cited by Bloomberg, the company is in talks with lenders to secure funding for a potential Chapter 11 bankruptcy filing, which could occur as early as next week. In response to this impending crisis, Express’s stocks plummeted to a new 52-week low, experiencing a sharp decline of 52% and trading at $0.62.

Decline in Beauty Stocks

Ulta Beauty, a prominent player in the beauty industry, saw its stock prices drop by over 13.5% to $448. This decline followed news that Mayflower Financial Advisors had acquired a significant stake in the company, purchasing 476 shares valued at approximately $233,000. Similarly, shares of beauty conglomerate Estée Lauder fell by 3.4% to $147, despite its recent foray into selling products on Amazon’s Premium store.

Positive Job Market Trends

On the macroeconomic front, positive news emerged with the release of data from ADP, a provider of human resources management software and services. The report indicated a substantial increase in private sector employment, marking the largest jump since July. This development has sparked optimism among investors, who anticipate similar positive trends in the upcoming March employment report. There are hopes that this may eventually lead to a reduction in interest rates by the Federal Reserve.

Rebound in the Crypto Market

Following a recent downturn, the crypto market showed signs of recovery today. Bitcoin, the leading cryptocurrency, saw a 1.3% increase, reaching $66,000. Ether, the second largest cryptocurrency, also experienced a 2% surge, hovering around $3,300. Other major cryptocurrencies followed suit, bouncing back from the previous day’s losses and displaying a positive trajectory.

Image/Photo credit: source url