Analysis of Meme Stock Craze

Traders who were astute enough to capitalize on the recent surge in meme stocks are reaping substantial gains. Unusual Whales, a platform that monitors trading data, shared on Twitter the impressive activity of a trader who invested $27,000 in call options on April 24 when they were priced at a mere $0.21 each. These options peaked at $13.63, resulting in extraordinary gains of 6,400%. The initial investment of $27,000 ballooned into an impressive $2 million, according to the firm’s calculations.

Financial Success Stories

In a similar vein, Unusual Whales also highlighted the trading decisions of an individual who exited the market after achieving a remarkable 4,000% return on a $32,000 investment in AMC Entertainment (AMC) stock options. This lucrative move occurred just nine days before the resurgence of Roaring Kitty’s Twitter account on a Sunday.

Call options offer buyers the opportunity to purchase a stock at a predetermined price and date, without any obligation to do so. The comparison between investors who weathered the storm of GameStop’s 2021 volatility and newcomers participating in the current frenzy remains unclear. Unusual Whales has not yet responded to inquiries from Decrypt regarding this matter.

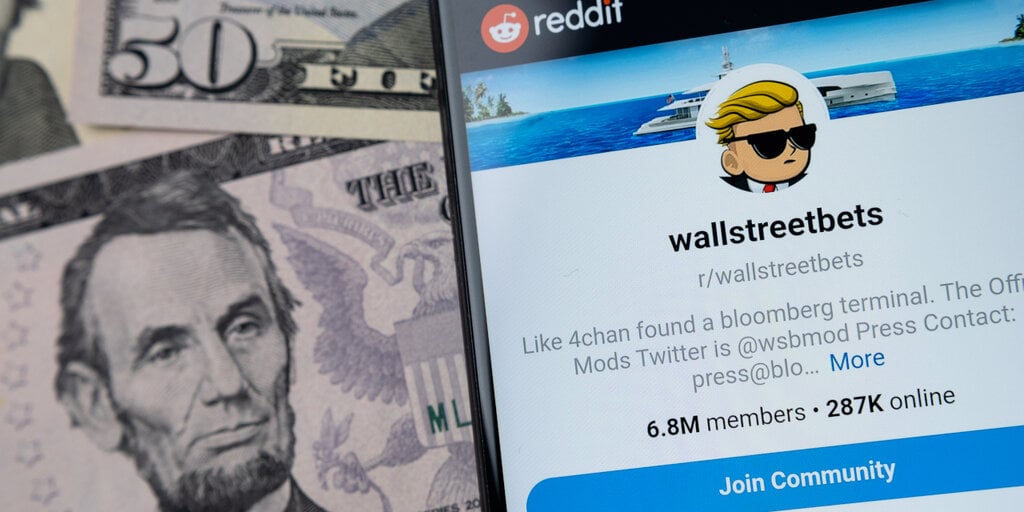

Resurgence of Meme Stock Mania

The phenomenon of meme stock speculation has resurfaced in the financial markets, particularly after an online figure that had a significant role in the 2021 GameStop rally, known as Roaring Kitty but whose real name is Keith Gill, resurfaced online after a prolonged absence. In the last five days alone, GME stock has surged by over 200%.

Keith Gill played a pivotal role in fueling the 2021 rally through his active participation on Reddit by sharing posts and live streams that garnered significant attention. His recent tweet, the first in nearly three years, served as a catalyst for traders to jump back into meme stocks as well as meme digital assets.

Historical Context

The rise of companies like GameStop on online forums in 2021 captured the imagination of amateur traders who actively boosted their stock prices. This unexpected surge led to chaos in the financial markets and necessitated intervention from regulatory bodies after hedge funds that had bet against these stocks experienced substantial losses when their values unexpectedly surged.

Simultaneously, the cryptocurrency market witnessed a surge in popularity, with meme coins and tokens experiencing significant value appreciation. These digital assets, often characterized by high volatility, have once again surged in value this week alongside traditional stocks.

Image/Photo credit: source url