BlackRock’s iShares Bitcoin Trust Achieves Remarkable Success in ETF Market

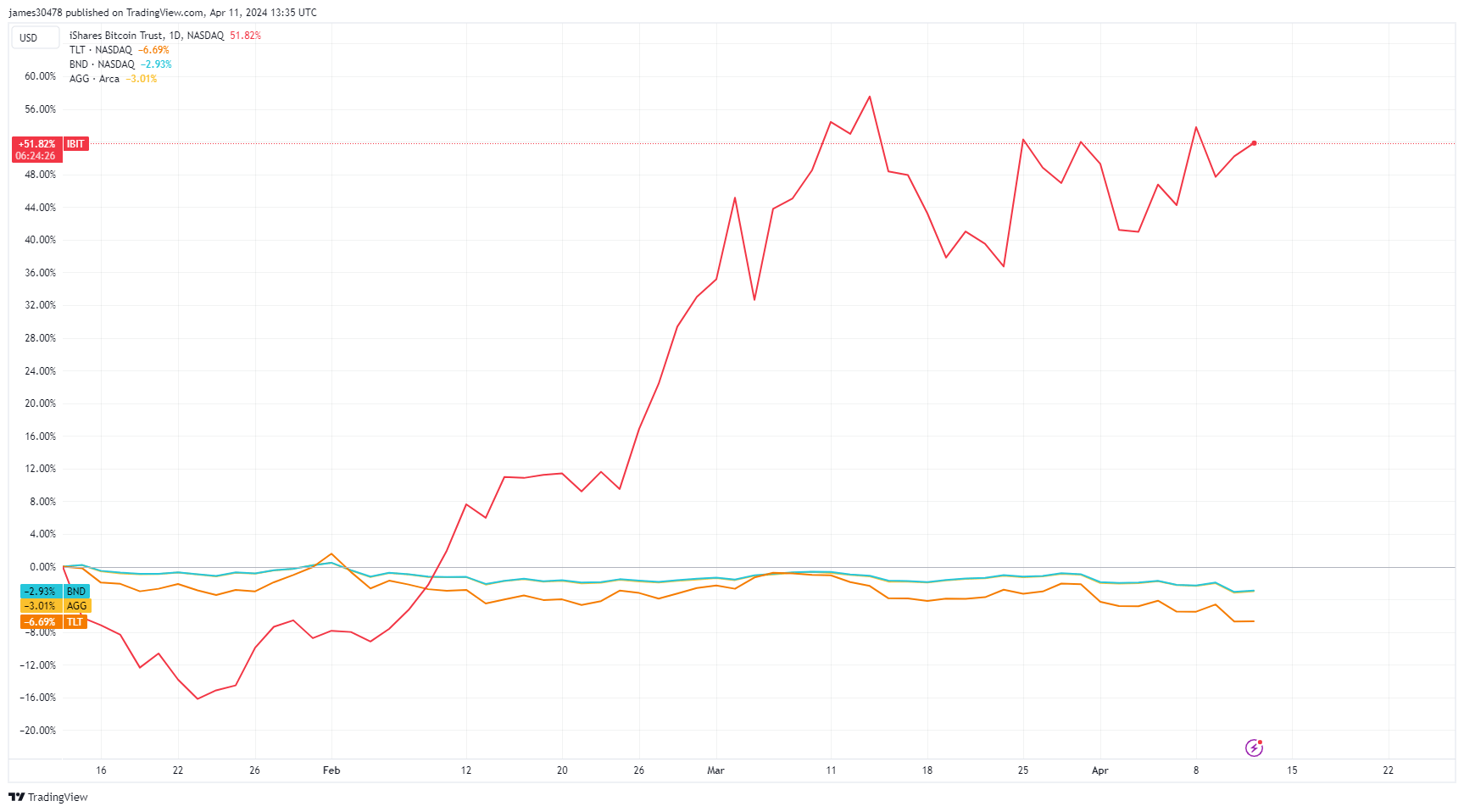

Since its launch in January, BlackRock’s iShares Bitcoin Trust (IBIT) has made a remarkable impact on the ETF market, surpassing expectations and setting new standards. The ETF currently holds an impressive 266,587 Bitcoin, translating to a market cap of approximately $19 billion. With a remarkable 52% year-to-date increase in share price, IBIT has outperformed bond ETFs by a significant margin, solidifying its position as a top performer in the market.

IBIT Ranks Among Top US ETFs

According to data from Coinglass, if ranked among other US ETFs based on market cap, IBIT would secure the 19th position, placing it between VanEck Semiconductor ETF and iShares MSCI Emerging Markets ETF. Additionally, IBIT’s impressive trading volume speaks to its success, with over $1.5 billion traded on April 10 alone, earning it the 20th spot compared to other ETFs. IBIT’s strong performance in terms of market cap and volume further cements its position in the top 20 ETFs.

IBIT Surpasses $300 Million in Trading Volume within 30 Minutes

Recent data from Coinglass reveals that within the first 30 minutes of trading on April 11, IBIT reached a trading volume of over $300 million, positioning it among the top 10 ETFs in terms of volume. This rapid surge in trading volume underscores the growing interest and confidence in IBIT as a desirable investment option in the ETF market.

As IBIT continues to shatter records and with the exciting prospect of more ETFs launching in key financial hubs such as Hong Kong and London, the future appears exceptionally bright for Bitcoin-based investment vehicles. Investors and enthusiasts alike are eagerly anticipating the continued success and growth of IBIT as it paves the way for innovative and lucrative investment opportunities in the digital asset space.

Image/Photo credit: source url