CoinShares Completes Acquisition of Valkyrie Funds LLC

European fund manager, CoinShares, has finalized its acquisition of Valkyrie Funds LLC, a significant move in the digital asset investment sector. In a recent announcement, CoinShares confirmed the completion of the acquisition, granting them sponsor rights to Valkyrie’s latest Bitcoin exchange-traded fund (ETF).

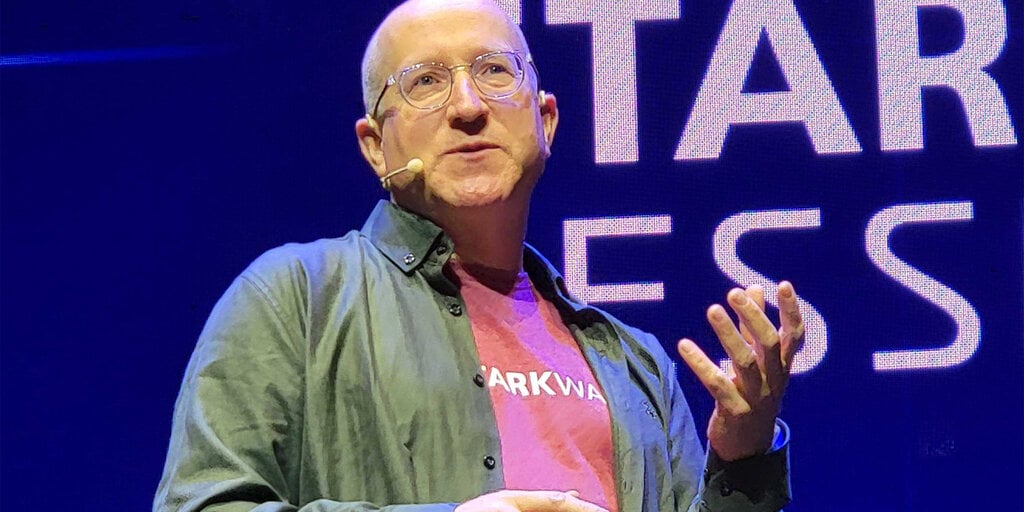

CoinShares CEO, Jean-Marie Mognetti, expressed his enthusiasm for the acquisition, stating that it marks another milestone in the company’s growth strategy, particularly emphasizing their expansion efforts in the U.S. market.

Background and SEC Approval

The acquisition comes after CoinShares, based in Jersey, revealed its intention to purchase Valkyrie’s ETF business back in November. Notably, the Securities and Exchange Commission (SEC) recently approved 11 spot Bitcoin ETFs on January 11, allowing these funds to be traded on U.S. stock exchanges. Since then, ten ETFs have been launched, contributing to substantial growth in the digital assets market.

Among these approved ETFs is the Valkyrie Bitcoin Fund, which trades on the Nasdaq exchange under the ticker symbol BRRR. CoinShares will now oversee this product, along with Valkyrie’s Bitcoin Miners ETF (WGMI), Bitcoin and Ether Strategy ETF (BTF), and the Valkyrie Bitcoin Futures Leveraged Strategy ETF (BTFX).

Impact and Assets Under Management

As a result of this acquisition, CoinShares is poised to increase its assets under management by approximately $530 million across these four funds. The BRRR ETF, while relatively modest with $297.3 million in assets under management, demonstrates the company’s commitment to diversifying its offerings in the digital asset space. By comparison, BlackRock’s iShares Bitcoin Trust currently boasts over $14 billion in assets, showcasing the scale and potential growth within the cryptocurrency investment landscape.

Overall, CoinShares’ acquisition of Valkyrie Funds LLC not only solidifies their presence in the U.S. market but also underscores their commitment to expanding and enhancing their digital asset investment offerings on a global scale.

Image/Photo credit: source url