The Fall of Sam Bankman-Fried and His Inner Circle

Former crypto executive Sam Bankman-Fried has been handed a 25-year prison sentence, capping one of the most notable financial scandals in history. However, the story doesn’t end there. Let’s delve into the lives of his close associates who were once part of his world at the failed cryptocurrency exchange FTX.

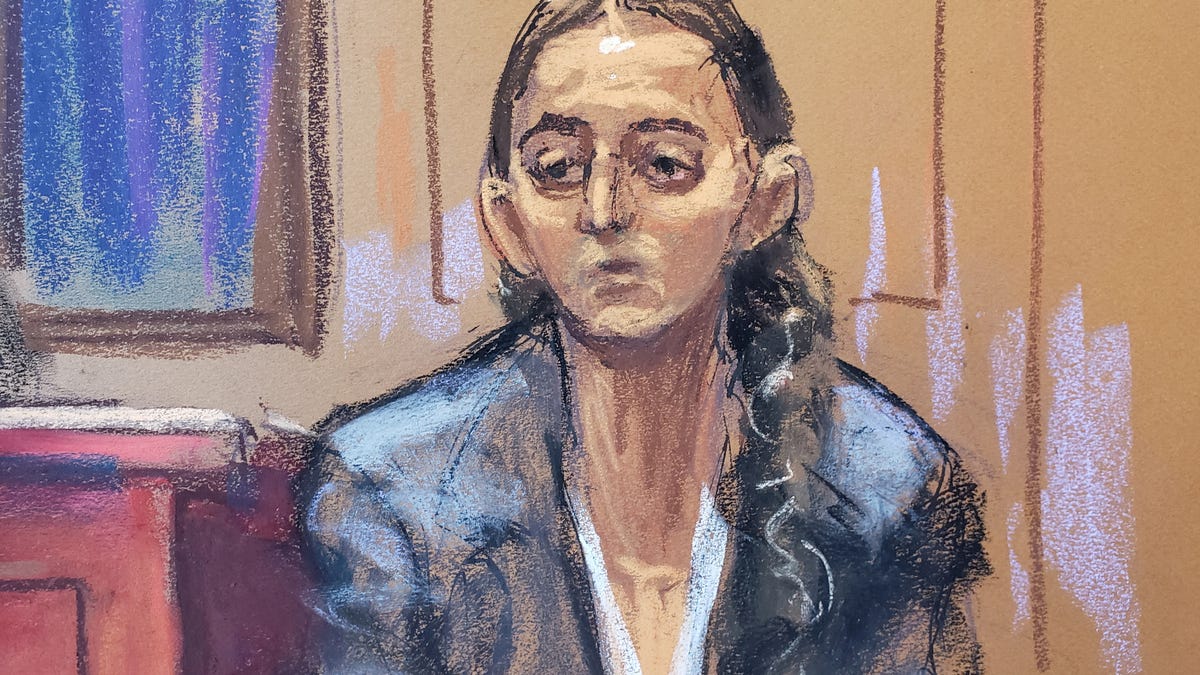

Caroline Ellison: Exposing the Truth

Caroline Ellison, aged 30, the former CEO of Alameda, FTX’s sister company, was once deeply intertwined with Bankman-Fried. She emerged as a key witness for the prosecution against him, shedding light on their fraudulent activities. Ellison, a Stanford University alumna and the daughter of MIT professors, confessed to orchestrating fraud and conspiracy alongside Bankman-Fried, ultimately defrauding customers and investors. In her testimony, she revealed how they misled FTX stakeholders by manipulating balance sheets and engaging in risky investments that depleted funds. Ellison’s testimony also unveiled Bankman-Fried’s ambition to become the President of the United States, adding a layer of complexity to the case.

Driven by a desire to mitigate her own sentencing, Ellison’s cooperation could potentially lead to a reduced sentence, although the outcome remains uncertain given the case’s high profile.

Gary Wang: A Coder Turned Accomplice

MIT graduates Sam Bankman-Fried and Gary Wang co-founded FTX in 2019. Wang, who specialized in math and computer science, played a crucial role in the development of the exchange. However, his journey took a dark turn as he confessed to aiding Bankman-Fried in defrauding customers. Wang’s coding skills were leveraged to modify code, enabling Alameda Research to siphon funds from FTX customers discreetly. Despite cooperating with prosecutors and hoping for leniency in sentencing, Wang faces the possibility of significant jail time due to the gravity of the case.

Nishad Singh: A Devastating Revelation

Nishad Singh, the younger brother of Gabe Bankman-Fried, found himself entangled in the web of deceit orchestrated by Sam Bankman-Fried. Initially starting his career at Facebook and later joining Alameda Research, Singh rose to become the chief engineer of FTX. He admitted to committing financial fraud, including money laundering and customer deception, under Bankman-Fried’s directives.

Similar to his counterparts, Singh cooperated with prosecutors by testifying against Bankman-Fried. He detailed how he was tasked with developing code that facilitated Alameda’s illicit borrowing from FTX. Singh’s testimony further revealed his inner turmoil, as he contemplated resigning from FTX but felt trapped due to potential repercussions for the company.

Having pleaded guilty to multiple charges, Singh expressed feelings of despair post-FTX collapse, a common reaction among white-collar offenders confronted by legal consequences. This display of remorse may impact the judge’s sentencing decision, reflecting Singh’s vulnerability as he navigates the intricacies of the criminal justice system.

Image/Photo credit: source url