The Strategic Position of Fish in the Bitcoin Market

Analysis of Glassnode data reveals that OG Bitcoin holders, known as Fish (yellow), those holding between 1 – 10 BTC, continue to maintain the lowest realized price by a considerable margin at a mere $15,630. When compared to Whales, whose realized price currently stands at $35,290, it becomes evident that Fish exhibit the lowest average cost per Bitcoin among all holders.

Noteworthy is the fact that historical data shows that whenever the Bitcoin price has reached the Fish realized price, it has consistently signaled the bottom of the market, as evidenced in the years 2011, 2014, and 2018.

Understanding Realized Price and Its Significance

The “Realized Price” chart elucidates the average cost at which Bitcoin holders have procured their coins, categorized based on the size of their wallets since 2010. This metric measures the average price paid for Bitcoin, taking into account the last movement of each coin. It is crucial to note that this metric may not align with the current market price, but rather represents the average acquisition cost over time.

By grouping wallets into segments such as ‘whales’ for large holders and ‘retail investors’ for smaller holders, the chart provides insights into whether larger wallets tend to pay more or less on average compared to smaller ones. This breakdown aids in comprehending the distribution of buying prices across various investor categories, shedding light on whether larger investors, who possess more Bitcoin, typically acquire their holdings at higher or lower prices relative to smaller investors.

An examination of the data since 2020 unveils that Fish have remained on solid ground without experiencing any losses, maintaining a considerable lead over other cohorts. This raises the question of whether Fish are dominated by holders of lost coins or represent astute investors in the Bitcoin space.

The Evolution of Fish in Relation to Market Conditions

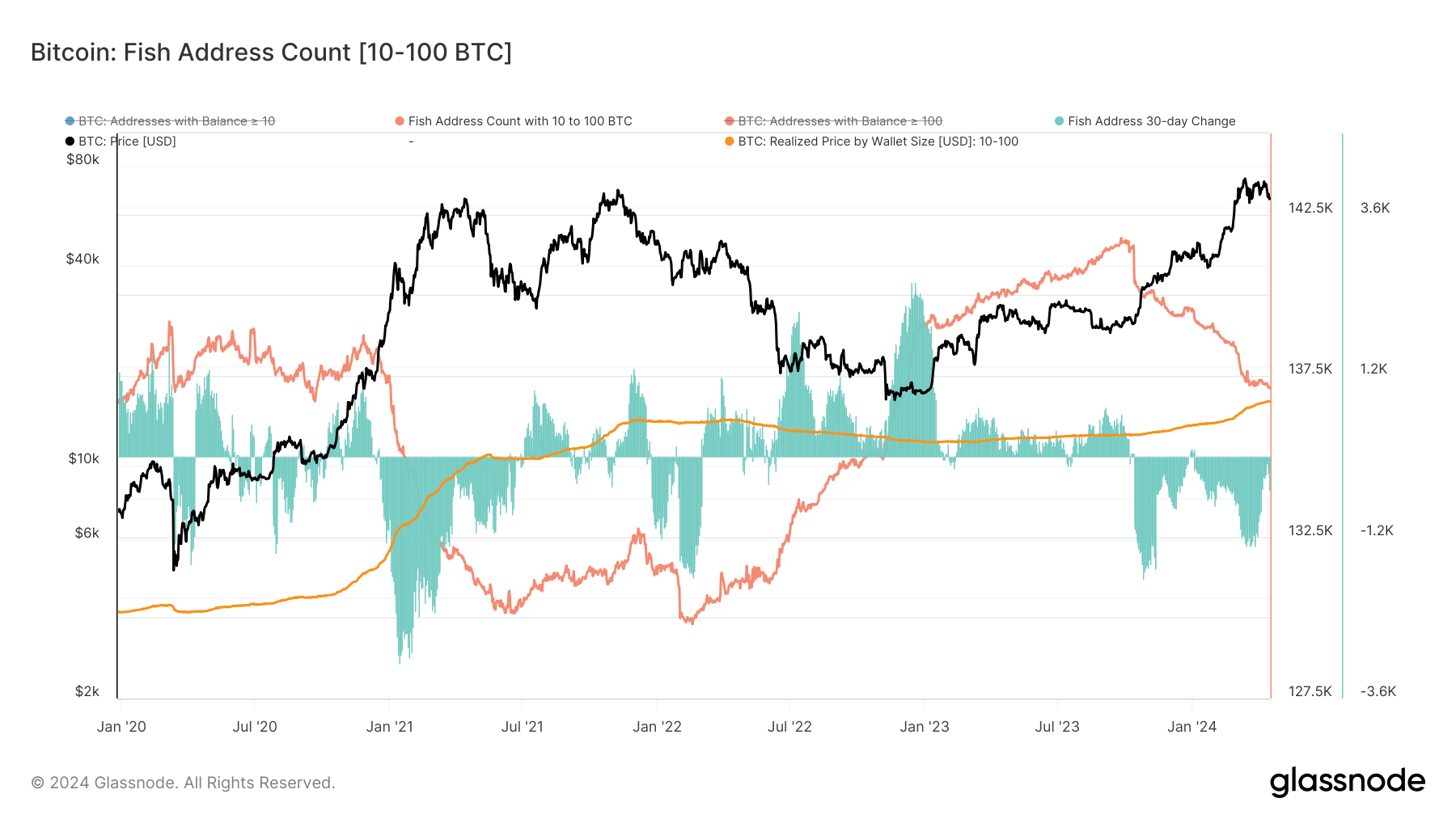

Analysis of address data indicates that the number of Fish addresses tends to surge during bear markets and dwindle in bull markets, underscoring that Fish are not solely composed of dormant Bitcoin holders. Notably, the period from November 2022 to October 2023 witnessed Fish accumulating the most Bitcoin as prices surged from $15,000, solidifying their reputation as savvy investors that seized the opportunity to “buy the dip,” earning them the esteemed title of ‘King’ Fish.

Despite a decline in Fish addresses since October 2023, the realized price for Fish has experienced an uptick from $13,282 to $15,530 in 2024, marking a notable 16.9% increase. In comparison, Bitcoin’s trading price has surged by 41% during the same timeframe. This trend indicates that while some Fish may be capitalizing on profits, others are transitioning into Sharks (holders of 100 – 1,000 BTC), showcasing a dynamic shift within the Fish cohort.

Image/Photo credit: source url