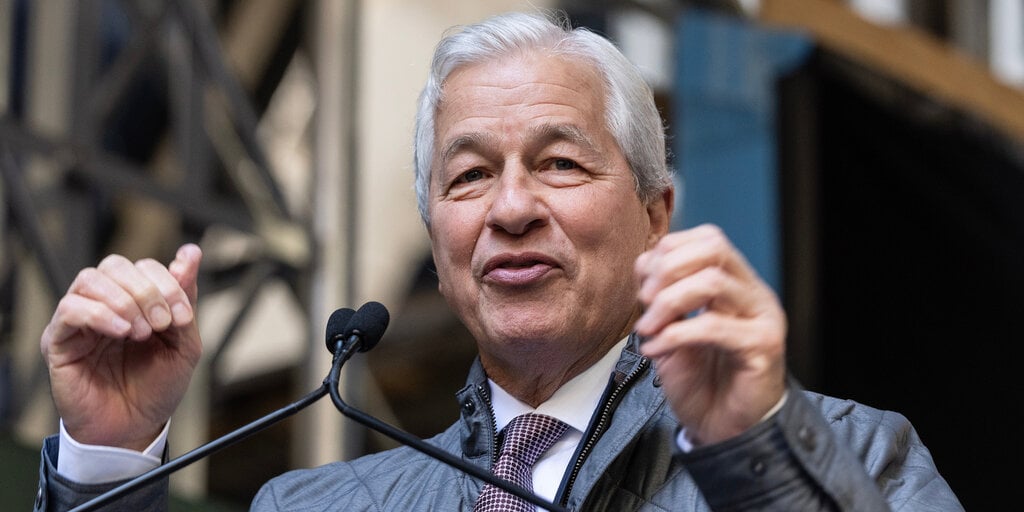

The Stance of Jamie Dimon Towards Bitcoin

Jamie Dimon, the CEO of JP Morgan, recently reiterated his strong opposition towards Bitcoin in an interview with Bloomberg. He referred to Bitcoin as a “fraud” and labeled it as a “public decentralized Ponzi scheme.” Despite his negative views on the digital currency, Dimon acknowledged the value of blockchain technology and smart contracts.

Dimon’s View on Blockchain and Smart Contracts

While Dimon maintains a critical stance towards Bitcoin, he acknowledged that cryptocurrencies with practical functionalities such as smart contracts could hold value. He mentioned in the interview that blockchain technology has the potential to offer innovative solutions, indicating a recognition of its merits beyond cryptocurrencies.

Dimon’s comments on smart contracts and blockchain technology were met with mixed reactions from the crypto community on social media platforms. Some users humorously interpreted Dimon’s criticism as a signal to buy more Bitcoin, highlighting the ongoing dynamics between traditional finance figures and cryptocurrency enthusiasts.

Regulatory Concerns and Investment Activities

Despite his skepticism towards Bitcoin, Dimon’s firm, JP Morgan, is actively involved in the cryptocurrency space through investments in spot Bitcoin ETFs. This juxtaposition between Dimon’s personal views and his firm’s financial activities underscores the complex relationship between traditional financial institutions and emerging digital assets.

It is worth noting that Dimon’s insistence on addressing the negative aspects of Bitcoin, such as illicit uses, aligns with broader regulatory concerns surrounding cryptocurrencies. He emphasized the importance of addressing these issues to ensure the legitimacy and security of the crypto market.

In conclusion, Jamie Dimon’s continued critique of Bitcoin reflects the ongoing debate surrounding the role of cryptocurrencies in traditional finance. While he remains a vocal critic of Bitcoin, his firm’s strategic investments suggest a nuanced approach to engaging with the evolving landscape of digital assets.

Image/Photo credit: source url