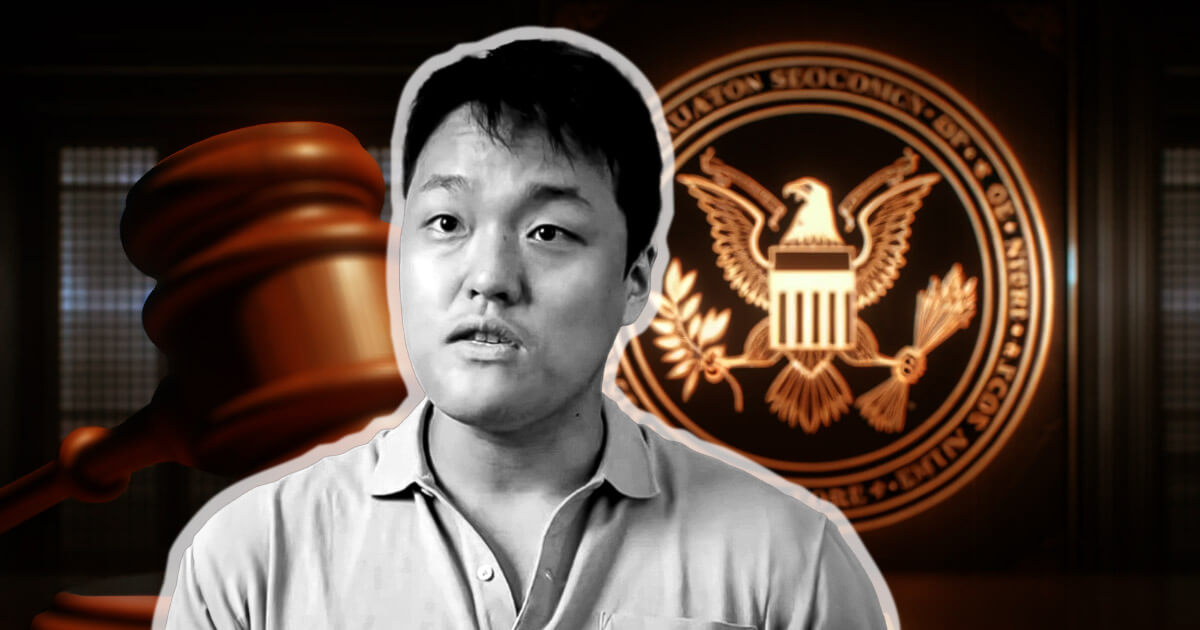

Do Kwon and Terraform Labs Found Liable in Multi-Billion Dollar Fraud Case

Following a detailed nine-day trial, a jury rendered a verdict of liability against Terraform Labs and its co-founder, Do Kwon, for defrauding investors and causing significant financial losses after the collapse of TerraLUNA in 2022.

SEC Announces Verdict

The Securities and Exchange Commission (SEC) made an official announcement regarding the verdict on April 5 through a press release. In the statement, the regulatory body underscored the gravity of the situation, referring to the fraudulent activities as a “massive crypto fraud” that led to devastating losses for investors.

The collapse of TerraLUNA resulted in the destruction of $40 billion in market value overnight, according to the SEC.

Despite the jury’s decision, the SEC has not yet imposed any penalties or injunctions against Terraform Labs, leaving the situation open to further developments.

Response from Terraform Labs

In response to the verdict, a Terraform Labs spokesperson voiced disagreement with both the jury’s decision and the overall premise of the lawsuit. The spokesperson claimed that the SEC lacked the legal authority to pursue the case against the company.

Additionally, Terraform Labs communicated their intention to appeal the ruling in a statement provided to Bloomberg.

Legal Challenges Await Do Kwon

For Do Kwon, the jury’s ruling in the civil trial carries implications of civil liability rather than criminal guilt. Separately, he faces criminal charges in the United States and South Korea related to his involvement in the collapse of TerraLUNA.

While a federal judge delayed the SEC civil trial to allow Kwon to participate, his extradition from Montenegro remains uncertain. The country’s Supreme Court recently intervened by halting the extradition process and requesting a reassessment.

Both the United States and South Korea are actively seeking Kwon’s extradition, with Montenegro previously approving requests from both nations before encountering multiple obstacles.

Background on SEC Case

The collapse of Terraform Labs’ TerraUSD stablecoin in May 2022 triggered a series of financial challenges. In addition to the sudden market losses mentioned by the SEC, TerraUSD’s prominent role in the crypto lending sector exacerbated liquidity concerns.

Following the TerraUSD collapse, the crypto market experienced a prolonged downturn, leading to a drop in Bitcoin prices from $35,000 in May to below $20,000 by November.

The SEC initiated an investigation into Terraform Labs shortly after the crisis emerged in June 2022. However, formal charges were not filed until February 2023. A ruling in December 2023 concluded that both Kwon and Terraform Labs had violated the Securities Act of 1933.

Overall, the jury’s findings against Do Kwon and Terraform Labs mark a significant development in the ongoing legal battle surrounding the collapse of TerraLUNA, underscoring the complexities of regulatory oversight in the cryptocurrency industry.

Image/Photo credit: source url