Analysis of MicroStrategy and Tesla’s Bitcoin Investments

As the digital assets market continues to evolve, notable US-based companies MicroStrategy and Tesla have made significant forays into Bitcoin investments, leading to vastly different outcomes.

MicroStrategy’s Bitcoin Investment Strategy

MicroStrategy, a renowned business intelligence firm, made its initial Bitcoin purchase in August 2020 when the digital asset was trading at approximately $10,000. Since then, the company has strategically accumulated Bitcoin, amassing a substantial amount that now constitutes over 1% of the total Bitcoin supply.

Tesla’s Bitcoin Ventures

On the contrary, electric vehicle giant Tesla entered the Bitcoin market at a later stage, acquiring the digital asset in January 2021 during the market frenzy that characterized that period.

According to data sourced from Arkham Intelligence, Tesla currently holds around 11,509 Bitcoin, with an approximate market value of $767.6 million. Additionally, its aerospace manufacturer subsidiary SpaceX possesses approximately 8,285 Bitcoin valued at $554.3 million. Together, the combined Bitcoin holdings of these two companies exceed 19,794 coins, equating to a total market value of around $1.3 billion based on prevailing market prices.

In 2021, Tesla purchased Bitcoin worth $1.5 billion, equivalent to approximately 38,900 BTC. However, the company divested a significant portion of its Bitcoin holdings in 2022. Had Tesla retained its entire Bitcoin stash until the present moment, it could have amounted to approximately $2.6 billion.

Comparative Stock Performance and Market Capitalization

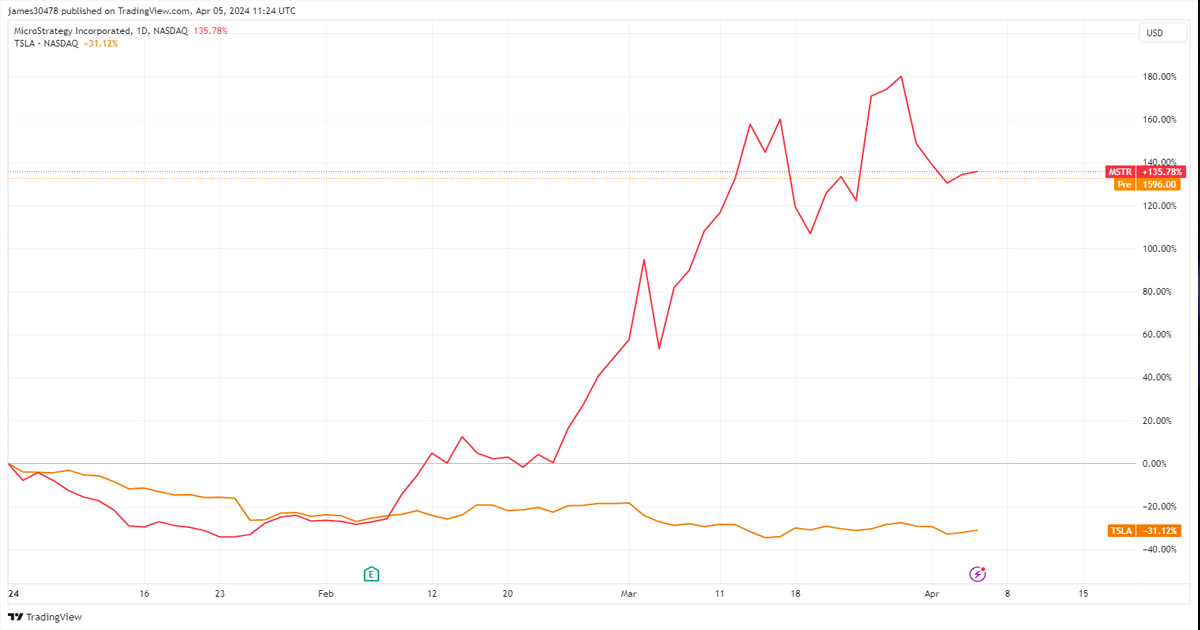

The contrasting approaches of MicroStrategy and Tesla towards their Bitcoin investments are vividly evidenced by their stock performance trajectories. MicroStrategy has experienced a remarkable surge of over 1200% in its stock value since venturing into Bitcoin, exemplifying the success of its strategic approach.

Conversely, Tesla’s shares have witnessed a decline of 31% year-to-date, showcasing the vulnerabilities and challenges inherent in its investment decisions. As a consequence, MicroStrategy has ascended the market capitalization rankings, solidifying its position among the top-performing companies, while Tesla has slipped to the 18th spot in terms of market capitalization.

The distinct paths taken by these two corporate entities in navigating the complex landscape of Bitcoin investments underscore the importance of strategic foresight, adaptability, and risk management in capitalizing on disruptive financial trends.

Image/Photo credit: source url