A New Era in Satellite Broadband

Amid increasing competition from burgeoning satellite broadband networks such as Starlink, two prominent companies dominating the traditional commercial communications spacecraft in geostationary orbit have announced a strategic merger. SES, headquartered in Luxembourg, will acquire Intelsat for a substantial $3.1 billion. This collaboration will result in the formation of a unified entity equipped with a robust fleet of around 100 multi-ton satellites revolving in geostationary orbit, which is situated more than 22,000 miles (nearly 36,000 kilometers) above the equator. Consequently, this amalgamated fleet will be more than double the size of the next-largest commercial geostationary satellite operator.

Shifting Demand Patterns

Despite a historic demand for communication services through sizable geostationary (GEO) satellites, there seems to be a gradual diminishing interest in these offerings. While major entrenched consumers like video media companies and the military have traditionally relied on geostationary satellites for meeting their telecom requirements, the landscape is evolving. An increasing segment of consumers, as well as some portions of the corporate and government markets, are now demonstrating an appetite for services provided by constellations of smaller satellites orbiting closer to Earth.

At the forefront of this transformation is SpaceX’s Starlink network, featuring over 5,800 operational satellites in its low-Earth orbit fleet positioned just a few hundred miles above the planet’s surface. While each of these Starlink satellites may be smaller in size compared to conventional geostationary platforms, their integration through laser communication terminals allows these spacecraft to collectively eclipse the capacity offered by internet networks anchored by geostationary satellites. Notably, Starlink boasts a subscriber base exceeding 2.6 million subscribers, as per reports from SpaceX.

Advantages of Low-Earth Orbit Satellites

Satellites in low-Earth orbit (LEO) present several distinct advantages over their geostationary counterparts. Due to their proximity to ground-based users, LEO satellites are capable of delivering signals with significantly lower latency. Moreover, the feasibility of mass-producing these satellites at a relatively low cost stands in stark contrast to the production costs associated with a single geostationary satellite, often exceeding $250 million encompassing both construction and launch expenses.

Adel Al-Saleh, the CEO of SES, emphasized the impact of this acquisition of Intelsat, stating that within the dynamic and fiercely competitive satellite communication industry, this strategic move will significantly enhance their multi-orbit space network, spectrum portfolio, global ground infrastructure, marketing capabilities, managed service solutions, and overall financial position.

Industry Dynamics Towards Consolidation

The trend of consolidation among major players in the geostationary orbit sector has been notably evident over the past decade in response to emerging competition. Eutelsat, the third-largest geostationary satellite operator, collaboratively merged with OneWeb last year, forming a company that offers a blend of GEO and LEO services. Similarly, pioneering satellite internet services provider Viasat acquired Inmarsat in an effort to broaden its connectivity offerings.

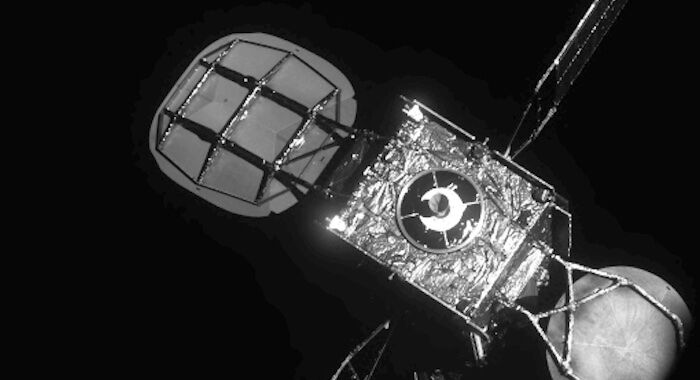

SES’s acquisition of Intelsat distinguishes itself owing to the expansive nature of their combined satellite fleets. Established in 1985, SES currently manages a fleet of 43 geostationary satellites alongside 26 broadband spacecraft situated in medium-Earth orbit (MEO), positioned a few thousand miles above the Earth’s surface. Interestingly, these MEO satellites serve as intermediaries between LEO and GEO satellites, offering reduced latency compared to geostationary networks while being sufficiently high to provide coverage without necessitating a multitude of satellites.

Intelsat, meanwhile, operates a notable 57 geostationary satellites primarily designated for television and video relay services. The merged entity, according to Al-Saleh, will extend its coverage to over 99% of the globe, catering to an array of communication bands. Presently, LEO broadband satellites in the Starlink and OneWeb networks transmit signals to user terminals primarily in the Ku-band.

Al-Saleh highlights that the accumulated network assets stemming from the collaboration between SES and Intelsat will span various bands including Ka-band, Ku-band, X-band, C-band, UHF, and specialized bands tailored for military applications. This diverse portfolio endows them with a distinctive advantage in the market, enhancing their ability to cater to the varied needs of their clientele.

In conclusion, the joint initiative anticipated by SES and Intelsat signifies a significant consolidation within the satellite communications domain, culminating in a formidable network poised to address the evolving requirements of a dynamic and competitive market environment.

Image/Photo credit: source url