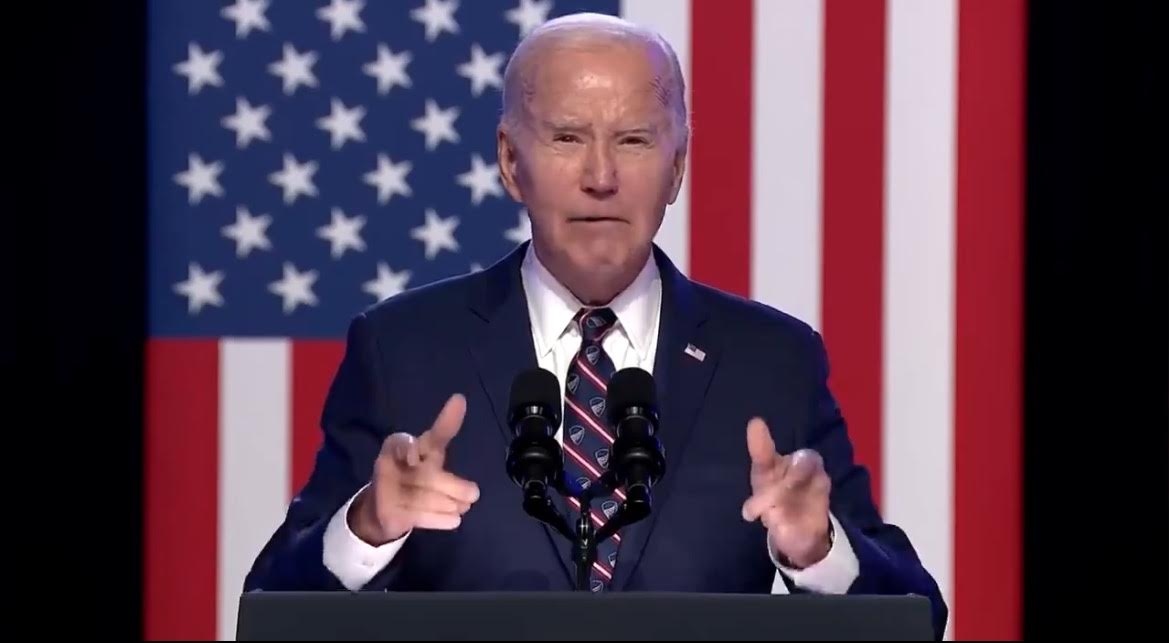

The Impact of Bidenomics on American Families

President Biden may take pride in the economic policies dubbed “Bidenomics,” which have brought about a significant shift in the size and reach of the government. However, to the average voter, these policies have only caused widespread hardship and upheaval. The economic landscape has been altered dramatically, leaving many struggling to reconcile their once solid life plans with the harsh realities of today. Daily decisions, such as postponing essential expenses like braces for a child or contributions to a teen’s college fund, have become the norm as families grapple with the financial repercussions of Bidenomics.

Understanding the Root of Inflation

President Biden has placed blame on corporate greed for the current inflationary trends, yet the American public knows better. The inflationary episodes of the 1970s were eventually quelled through stringent measures including sharp recessions and spending cuts during the Reagan era. For nearly four decades following this period, the nation enjoyed a period of stable, low-inflation growth.

However, the onset of the pandemic saw federal spending surge in a manner contrary to the Reagan-era approach. Federal spending, which had previously averaged at 20.5% of the GDP since 1982, suddenly skyrocketed to 60.5% of the GDP during the years 2020-21 – an unprecedented increase of 20%. President Biden further allocated an additional $6.2 trillion over a ten-year period on top of the $4.8 trillion in 2021 spending projected pre-pandemic.

The Harsh Realities Faced by Working Families

With the substantial rise in inflation since Biden took office, prices have surged by 17.9%, outpacing the 12.7% increase in wages. This discrepancy has left working families financially strained, being on average 4.5% worse off than before. Many households find themselves living paycheck to paycheck, with credit card delinquencies reaching a decade-high rate. Additionally, the share of family budgets allocated to food expenses is at a thirty-year high, causing distress among a majority of Americans when grocery shopping.

Ripple Effects on the Housing Market

Bidenomics has not only impacted consumer goods prices but also directly influenced the housing market. The Federal Reserve’s attempts to curb inflation resulting from Biden’s policies through increased interest rates have significantly affected potential homeowners. Homebuyers are now facing roughly $1,300 more in monthly mortgage payments than before Biden took office, pricing many out of the housing market. Commercial real estate is also experiencing a tumultuous period, with falling property values due to high-interest rates and an increased number of remote workers.

The Verdict on Bidenomics and President Biden’s Response

Despite President Biden’s claims of economic success and reassurances in the face of inflation, the reality for many American families tells a different story. The President’s economic advisors have touted perceived gains in consumer sentiment surveys, but these successes pale in comparison to past recessions. The rift between Bidenomics and the economic well-being of the American public is evident, with only a mere 14% of voters acknowledging any positive impact from the administration’s economic policies.

President Biden’s handling of the inflation crisis has left much to be desired, with his attribution of the issue to corporate greed rather than examining the ramifications of excessive federal spending. By neglecting the lessons of history and failing to acknowledge the mistakes of the past, the President has inadvertently divided the nation over economic issues.

Image/Photo credit: source url