Analysis of Bitcoin ETFs by Jim Bianco, Head of Bianco Research

Jim Bianco, the head of Bianco Research, has been an outspoken critic of Bitcoin ETFs, citing concerns about centralization. Bianco recently emphasized the lack of decentralization in spot ETFs, stating that they are not truly decentralized despite their branding.

Additionally, Bianco expressed skepticism about the main investors in Bitcoin ETFs, describing them as “orange FOMO poker chips for paper-handed small-time traders (degens).” This characterization suggests that he views these investors as easily swayed by market trends and lacking conviction in their investment decisions.

Despite Bitcoin’s price surge to approximately $63,000 at the time of reporting, up significantly from $49,000 at the ETF launch, Bianco warned that holders of these ETFs may be on the verge of selling if the cryptocurrency’s value experiences a downward trend. This caution indicates his belief that these investors may not have gained much from the price appreciation and could be quick to offload their holdings.

Insights from Data and Citibank

According to data from Farside, Bitcoin ETFs have experienced outflows on eight out of the last 11 trading days, despite the cryptocurrency’s price fluctuating between $60,000 and $67,000. This data suggests a potential lack of sustained investor interest or confidence in these ETFs.

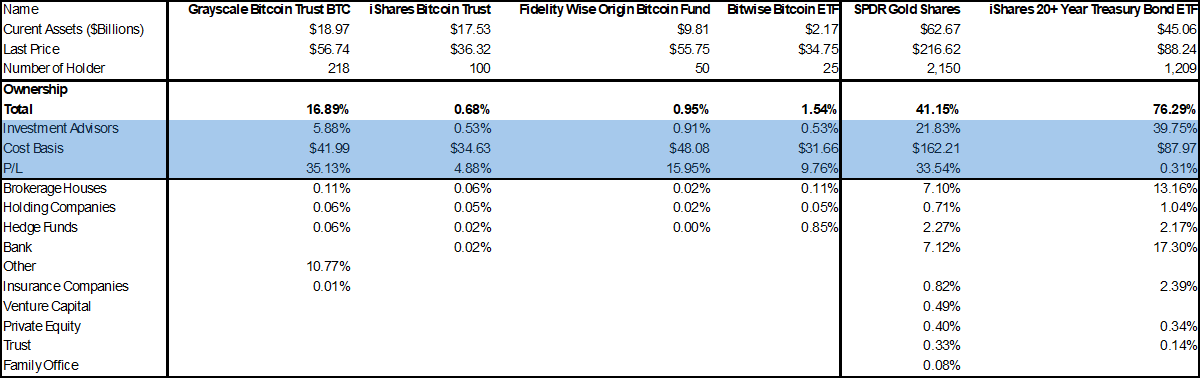

Citibank data, shared by Bianco, revealed that Investment Advisors represent about 35% of all ETFs but hold less than 1% of the new spot Bitcoin ETFs offered by prominent players like BlackRock, Fidelity, and Bitwise. This significant disparity in allocation compared to traditional assets like the SPDR gold shares ETF (GLD) and the iShares 20+ year treasury bond ETF (TLT) raises questions about institutional participation in Bitcoin ETFs.

Analysis from Bloomberg ETF Analyst Eric Balchunas

In contrast to Bianco’s skepticism, Bloomberg ETF analyst Eric Balchunas offered a different perspective on the future of Bitcoin ETFs. Balchunas noted that the majority of institutional holdings have yet to be disclosed through 13F filings and predicted that over 500 advisors may report ownership of spot BTC ETFs by May 15.

He anticipates that advisor ownership could eventually reach levels comparable to the futures Bitcoin ETF BITO, potentially reaching 40% over time. Balchunas pointed out that advisors typically move slower than retail investors but expect a gradual increase in their participation in Bitcoin ETFs.

Implications for Bitcoin ETFs

The evolving dynamics between institutional and retail demand for Bitcoin ETFs will play a pivotal role in shaping their future performance. The contrasting views of Jim Bianco and Eric Balchunas on investor behavior and advisor participation underscore the complexity and uncertainties surrounding these emerging investment products.

Image/Photo credit: source url