Cinemark’s Remarkable Turnaround in the Wake of the Pandemic

Not long ago, Cinemark faced dire circumstances during the tumultuous times of the COVID-19 pandemic. The company was forced to take drastic measures, such as laying off half of its corporate workforce and furloughing over 17,000 theater employees. These actions were a response to the public’s heightened preference for streaming content at home, diminishing the appeal and safety of traditional movie theaters. In the face of such challenges, Cinemark’s future seemed uncertain.

Resurgence in the Film Industry

However, with Hollywood and the film industry gradually returning to pre-pandemic norms, there is newfound hope on the horizon for movie theater chains. A recent report by The Wrap highlights an optimistic shift in perspective regarding Cinemark’s stock. Well-respected Wells Fargo analyst, Omar Mejias, notably upgraded his evaluation of Cinemark from a “sell” to a “buy.” This upgrade is a significant indication of the rising confidence in Cinemark’s potential for growth and success.

The accompanying research note enthusiastically proclaims, “Movies are back!” This statement encapsulates the industry’s renewed vigor and positive outlook. Consequently, Cinemark’s stock experienced a notable surge, climbing as much as 9% in a single day.

Strategic Business Initiatives

Despite prevailing economic challenges, including concerns over inflation and consumer spending habits, Cinemark remains steadfast in its commitment to providing exceptional cinematic experiences. With a strategic focus on enhancing customer offerings, the company emphasizes the allure of premium amenities, such as luxurious reclining seats. This approach aims to entice moviegoers to indulge in an unparalleled movie-watching experience, making each visit a memorable occasion.

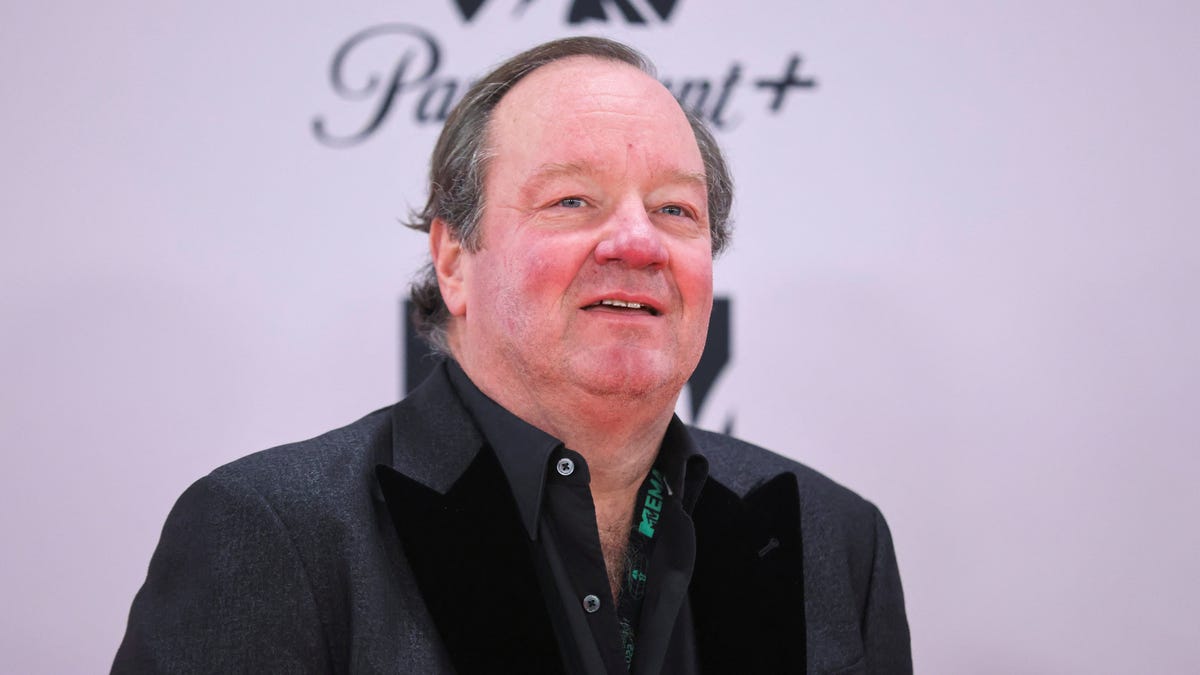

CEO Sean Gamble articulates this sentiment by suggesting that individuals may be more conservative in their entertainment expenditures overall. However, when it comes to the cinematic experience, there is a willingness to splurge and savor the moment. This unique positioning sets Cinemark apart in an increasingly competitive landscape.

Remarkable Performance and Market Share Growth

Cinemark’s resilience and innovative strategies have not gone unnoticed, as evidenced by its robust financial performance. During the release of its latest earnings report in February, Cinemark surpassed Wall Street’s expectations, demonstrating its ability to thrive amidst adversity. Remarkably, the company reported an increase in market share, a feat unmatched by its competitors within the U.S. cinema industry.

In light of these achievements, Wells Fargo’s Mejias projects a promising future for Cinemark’s stock. With a projected target price of $23 by the end of 2024, he anticipates a substantial resurgence that could see Cinemark’s shares reach their highest value in three years. This forecast underscores the company’s remarkable turnaround and its potential for sustained growth and success in the evolving film exhibition landscape.

Image/Photo credit: source url