Analysis of U.S. VC Investments in the First Quarter of 2024

In the initial quarter of the year 2024, the U.S. witnessed a notable decline in the value of VC investments. The deal value amounted to $36.6 billion spread across 2,882 deals, as reported by Pitchbook and the National Venture Capital Association. This figure marked a substantial decrease from the $51.6 billion invested in 4,026 deals during the corresponding period in the previous year.

The quarter under review was characterized as relatively calm or weak in terms of venture capital investments. While a few large deals were closed, the overall deal count remained considerably high when compared to historical data. The absence of outlier deals is particularly noteworthy, indicating a scarcity of available capital, according to the report.

Valuation and Market Trends

Despite the overall decrease in quarterly deal value, data suggests a slight increase in median valuations across various stages. This uptick can be attributed to the solid performance of public markets, leading to moderate multiple expansions. Furthermore, the preference for fundamentally strong companies has enabled them to continue raising capital despite the sluggish venture market conditions.

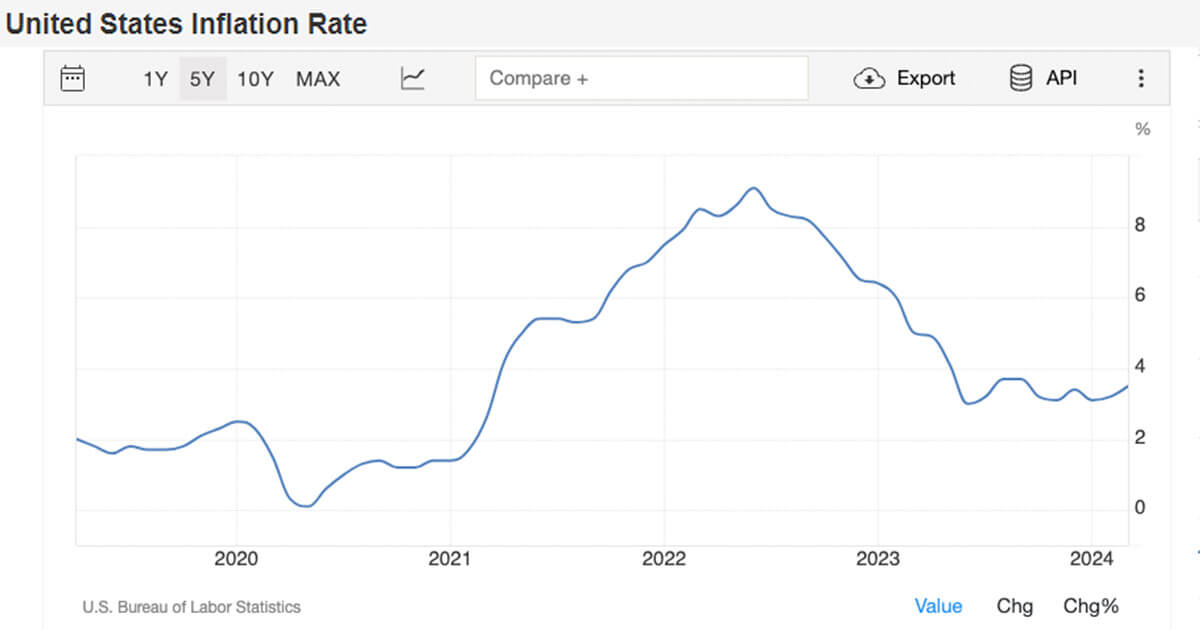

Investors are exercising caution due to persisting uncertainties in the economic landscape. Factors such as persistent inflation, delayed interest rate cuts, and looming recession threats are contributing to a sense of apprehension in the market. Consequently, the NVCA projects a subdued growth trajectory in deal activity in the near future.

U.S. Exits and Fundraising

The IPOs of Reddit and Astera Labs emerged as the highlights of the quarter, collectively accounting for a significant portion of the total exit value. The prospect of increased IPO activity has generated optimism, given the prolonged period of sluggish exits over the past two years. While the IPO performances were encouraging, uncertainties linger regarding the future outlook of these companies.

On the fundraising front, the U.S. VC market experienced a sluggish pace during the quarter, with only $9.3 billion raised. This amount represents a mere 11.3% of the total funds collected in the already subdued market environment of 2023. Despite the abundance of dry powder, tepid fundraising signals a cautious stance among Limited Partners (LPs) towards venture capital, hinting at a challenging dealmaking landscape ahead.

European Market Overview

Deals in Europe

European venture capitalists initiated the year cautiously, recording $17.5 billion (€16.4 billion) in deal value across 2,395 financings. The slower-than-anticipated growth in the European Union has exerted pressure on companies within the region, impacting investment activities. However, seed and early-stage valuations have demonstrated resilience, attributed to their insulation from the fluctuations of public markets.

Exits and Fundraising in Europe

The first quarter of 2024 marked the seventh consecutive period where exits in Europe generated less than $7.5 billion (€7 billion) in value. With just three exits surpassing $107.3 million (€100 million) in value, the constrained access to public markets for VC-backed companies poses challenges to returns and investment dynamics. Fundraising in Europe has also been subdued, with only 47 funds closed and an addition of $5.37 billion (€5 billion) to the available capital pool.

Global Market Dynamics

Global Deal Trends

Global VC trends mirrored those observed in the U.S. and Europe, with muted deal activity during the quarter. A total of 10,222 deals accounted for an investment of $75.9 billion worldwide. Both Asian and Latin American markets struggled to sustain the investment momentum witnessed in the preceding year, aligning with the broader global economic challenges impacting venture activity.

Exits and Fundraising on a Global Scale

Global exits registered a decline, with exit value hitting a low at $30.7 billion, the lowest quarterly figure since Q4 2016. The reluctance of large companies to go public has implications on market returns and cash flow management. Fundraising globally also faced headwinds, with commitments in Q1 amounting to a mere fraction of the figures recorded in previous years. The lack of capital redistribution to LPs has dampened confidence in recommitting to the venture market amidst the current environment.

Image/Photo credit: source url