The SEC’s Stance on Ethereum as a Security

The Securities and Exchange Commission (SEC) is on the brink of potentially categorizing Ethereum as a security, according to expert insights on the rejection of various spot Ethereum exchange-traded fund (ETF) applications. The regulator is slated to make a decision on VanEck’s ETF application on May 23, with the final deadline for ARK Invest/21Shares’ application falling on the subsequent day. Additionally, BlackRock, Fidelity, and Grayscale are awaiting a verdict on their applications from the SEC.

In March, the SEC raised concerns regarding the approval of BlackRock’s application and Nasdaq’s proposal to list the former’s product. The SEC’s notice queried whether Nasdaq complied with the exchange’s rules for Commodoty-Based Trust Shares by filing its proposal accurately.

Scott Johnson, a general partner at Van Buren Capital, highlighted the implications of the SEC’s query, insinuating that the regulator may deny the applications based on improper classification. Johnson emphasized the potential disapproval on the basis that these ETF filings were not filed as commodity-based trust shares, therefore failing to qualify as they are holding a security.

The SEC’s Likely Decision on Ethereum

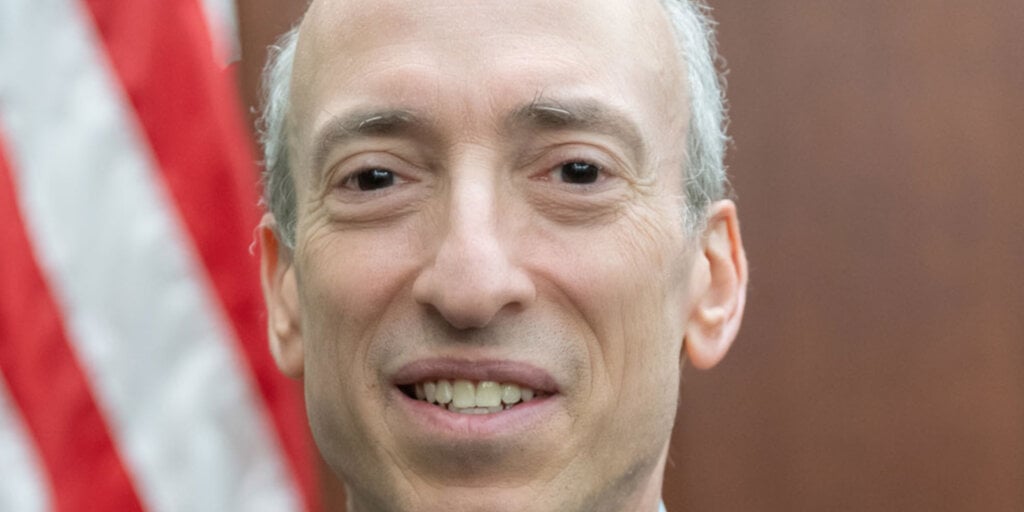

Speculations suggest that the SEC might explicitly state that Ethereum is a regulated security in its anticipated rejections of ETF applications. However, Terrence Yang, managing director at Swan Bitcoin, expressed doubt regarding this outcome. Yang noted that SEC Chair Gary Gensler and his team are unlikely to make such a bold move due to political pressures in the crypto space.

Following the approval of spot Bitcoin ETFs in January, expectations for a similar treatment for Ethereum ETFs have dwindled. Market predictions on platforms such as Polymarket have signaled a pessimistic 16% chance of ETF approvals this month.

While Gensler has affirmed Bitcoin as a commodity, his stance on Ethereum remains uncertain, with no definitive statements provided thus far. Recent legal actions from Ethereum software company Consensys have placed the SEC under scrutiny, alleging that the regulator internally views Ethereum as a security.

The Crypto Industry’s Response to SEC Decisions

Historically, the SEC has rejected Bitcoin ETF applications over concerns of fraud and market manipulation in the spot market. However, the approval of Ethereum futures ETFs in October last year has shifted the landscape. Yang predicts that any indications of market manipulation in the future could lead to legal challenges against the SEC, similar to the ordeal following the Bitcoin ETF rejections.

The crypto industry’s well-funded lobbying efforts could potentially intensify political backlash against the SEC in the event of unfavorable ETF decisions. The regulatory landscape surrounding Ethereum ETFs remains uncertain, with a delicate balance between investor interests and regulatory scrutiny.

Image/Photo credit: source url