Goldman Sachs Elevates Coinbase Rating Amid Crypto Surge and Increased Market Dominance

Coinbase, the prominent US-based cryptocurrency exchange, has experienced a significant uptick in its market share subsequent to the introduction of a series of spot Bitcoin exchange-traded funds (ETFs) in January. This development has not gone unnoticed by financial analysts at Goldman Sachs, who have opted to enhance their rating on Coinbase shares from selling to neutral while adjusting their price target to $282.

Analysts’ Declaration

“We are upgrading shares of COIN to Neutral from Sell, as crypto prices have surged to all-time highs, and COIN daily volumes have reached levels not seen since 2021 driving a 48% increase to our revenue estimates since early February.”

The oticeable shift in the analysts’ stance is underpinned by a recognition of the evolving dynamics within the cryptocurrency market and the resulting ramifications on Coinbase’s operational performance. This decision stands in stark contrast to the previous downgrade of Coinbase’s stock from Neutral to Underweight by JPMorgan analysts. The downward revision was precipitated by market pressures and anticipated revenue redirection away from Coinbase following the unveiling of the aforementioned ETFs.

Stellar Stock Performance

Over the course of the last month, Coinbase’s stock has exhibited remarkable growth, currently hovering around $244 during pre-market trading sessions, representing an impressive 105% surge within the preceding month, as per data sourced from Yahoo Finance.

Market Share Expansion

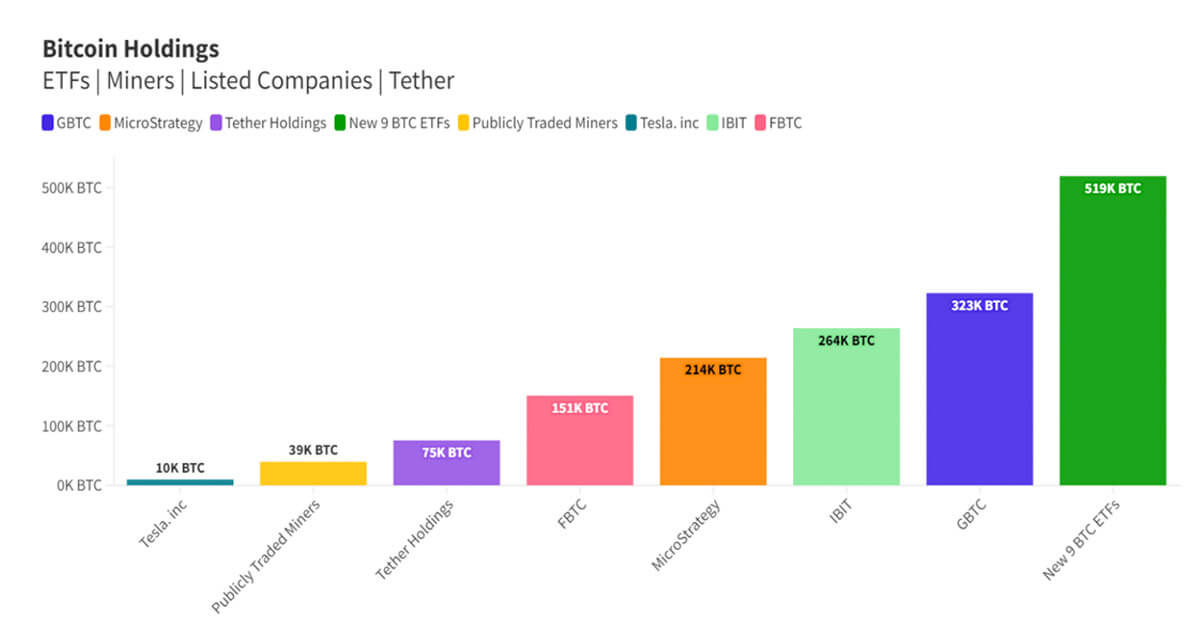

Evidencing its resounding dominance, Coinbase’s market share has experienced a notable spike from 47% to 60% within the past three months, coinciding with the approval of Bitcoin ETFs in January. The statistics, derived from blockchain analytics firm Kaiko, underscore the platform’s escalating user engagement, propelling Coinbase’s app to a notable 13th rank among US finance applications, according to observations from Sensor Tower, a platform monitoring app growth.

Nevertheless, amidst its meteoric rise, Coinbase has encountered technical hitches, culminating in users facing zero balances in their accounts. CEO Brian Armstrong attributed this glitch to the unprecedented surge in traffic engendered by Bitcoin’s surge to fresh record highs. In addition to technical stumbling blocks, Coinbase is also grappling with a regulatory maze, notably contending with the US Securities and Exchange Commission over the preceding year.

This recalibration by Goldman Sachs embodies a pivotal moment for Coinbase as it navigates an increasingly complex landscape embroiled in market dynamism and regulatory scrutiny.

Image/Photo credit: source url