Analysis of Recent US Government Bitcoin Sale

In a recent transaction, the US government sold 1,999 Bitcoin (BTC) worth around $130 million from a wallet associated with Silk Road to the digital assets exchange Coinbase. According to the Arkham Intelligence firm, the total spent in the transaction was 1,999.999 BTC, leaving approximately 29,799.99012413 BTC unspent.

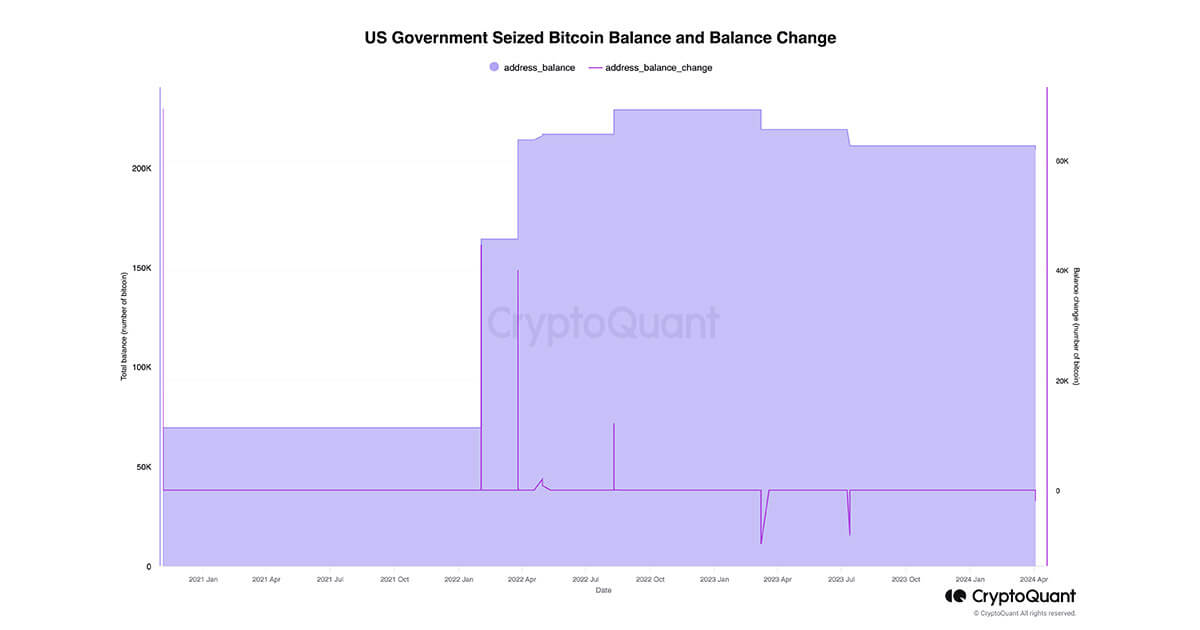

This sale had a significant impact on the US government’s seized BTC balance, reducing it from 210,800 BTC to 208,800 BTC, based on data from CryptoQuant. With this transaction, the government now holds less than 1% of the total BTC supply.

Government’s Strategic Approach

This recent sale is part of the government’s strategic plan to gradually offload its seized BTC holdings, as indicated by CryptoQuant data. A similar strategy was employed in March 2023 when about 10,000 BTC were sold as the price of BTC hovered around $21,500. Interestingly, this sale coincided with a local price bottom, dipping to around $20,000 during the SVB collapse. Another notable sale of roughly 8,200 BTC took place on July 12, 2023, with Bitcoin trading at approximately $30,000.

This sales strategy by the US government bears resemblance to the UK government’s decision in 1999 to sell over half of its gold reserves at about $270 per ounce. This move aligned with a cyclical bottom before gold entered a substantial bull run lasting several years.

In conclusion, the data suggests that the US government tends to sell its seized BTC at opportune moments, often during local market lows. This approach reflects a deliberate strategy aimed at maximizing returns on these asset disposals.

Image/Photo credit: source url